Staff Reporter :

Remittances sent by overseas Bangladeshi workers rose marginally by 4.11 per cent on a month-on-month basis in January this year but fell by almost 20 per cent in the first seven months of the current financial year over the comparable period last year.

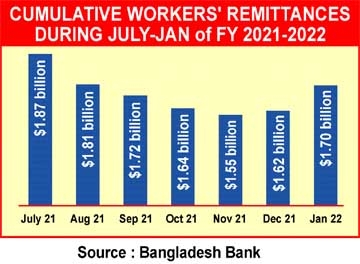

Bangladesh Bank (BB) data issued on Tuesday showed that the inflow of remittances was $1.70 billion in January 2022 against $1.62 billion in December 2021. The country had received $1.96 billion remittances in January last year.

The cumulative remittances reached $11.93 billion during the July-January of the current financial year (2021-22), according to BB data.

However, during July-January of the last financial year (2020-21) inflow of remittances was $14.90 billion.

Analysts said the remittances narrowed 20 per cent during the first seven months of this financial year (FY) as money transfers through informal channels such as “hundi” have might been increased.

Hundi, an illegal cross border financial transaction, was stopped during the peak of the pandemic when different nations had imposed lockdown to contain the spread of the coronavirus.

But, the illegal transactions though digital financial services have started to rise once again in recent times keeping pace with the gradual opening of the global economy, they added.

Earlier, the government raised the incentive on remittances from 0.50 per cent to 2.5 per cent to encourage the expatriates to send it through legal channel.

Some banks also provided an additional 1 per cent to attract remittances through the particular banks.

The expatriates sent $1.87 billion in remittances July, $1.81 billion in August, $ 1.72 billion in September, $1.64 billion in October, $1.55 billion in November, $1.63 billion in December and $1.70 billion January of the current FY.

According to the analysts, remittance has been the backbone of the Bangladesh economy as it helps financing the country’s trade deficit and external debt repayment.

Bangladesh’s trade deficit escalated 160 per cent in the first four months of the ongoing FY in the wake of a surge in import payments against lower exports earnings.

Between July and October, the trade deficit totalled $9.09 billion in contrast to $3.49 billion a year ago, a data from the central bank showed.

The money sent by more than 10 million expatriates account for nearly 12 per cent of Bangladesh’s GDP.

Besides, the inward remittances to Bangladesh has lifted many people from poverty and served as a cushion for families during difficult times, as the country saw during the pandemic.

According to a recent study by the World Bank, remittance has helped to reduce the poverty level in Bangladesh by 1.5 percent.

Bangladeshi expatriates remit record $24.77 billion in FY21, marking a robust 36.1 percent year-on-year rise from $18.2 billion in 2019-20.