New Nation Report :

During his visit to Europe last month, US President Donald Trump pledged to expand gas exports by 15 million cubic feet (mcf) per year, up from the current 22 mcf. Even before the announcement, US LNG exports to Europe increased dramatically this year.

According to preliminary Refinitiv statistics, liquefied natural gas (LNG) exports from the United States increased over 16 percent last month to a new high, with shipments to Europe continuing to dominate.

As a result of Russia’s invasion of Ukraine, European countries are trying to reduce their gas imports from Russia while also trying to replenish depleted supplies.

For the fourth month in a row, Europe was the top consumer of US LNG, accounting for almost 65 percent of total exports. According to the figures, almost 12% of exports travelled to Asia and 3% to Latin America. About 20 vessels, accounting for 20% of total volume, had not yet notified their destination.

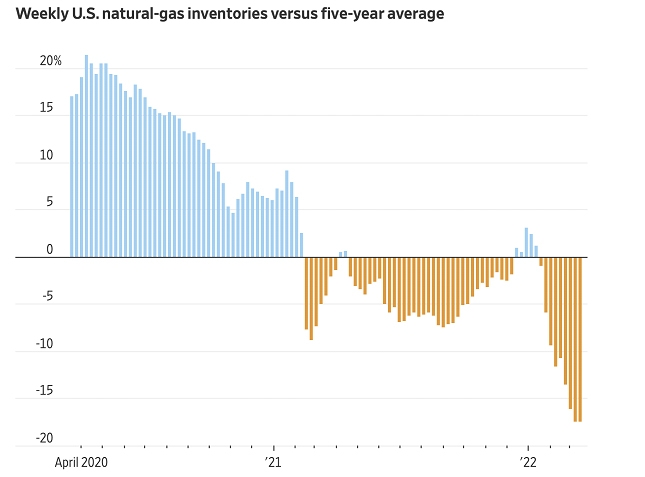

While LNG exports from the United States to Europe have increased dramatically since November, analysts say more is needed because European gas reserves are only around a quarter full, well below the five-year average of around 34% for this time of year.

The European Commission has advised that inventories be 80 percent full by November 1, implying that demand will remain robust after the winter heating season finishes.

LNG prices have risen from $6 per million metric British thermal unit (mmbtu) in January 2021 to $35 this January, as a result of increased shipment to Europe. It has since been trading in the $30-38 range. The Asian spot benchmark, the Japan-Korea-Marker, was recently trading about $34 per mmbtu. The last time the price was this low was in 2014, when spot LNG hit $22 per million British thermal units.

After Vladimir Putin signed an order threatening to demand ruble payments from “unfriendly countries,” stoking fears that Moscow may be preparing to slash gas supply, German chancellor Olaf Scholz said he expected his country will be able to pay for Russian gas in euros starting Friday. Other European also refused Russia to in ruble.

Scholz said during a press conference in Berlin on Thursday, immediately after the Kremlin revealed Putin had signed the directive, that energy contracts between Germany and Russia stated payments in euros, occasionally in dollars.

Scholz’s reply to the Kremlin’s decision matched that of Mario Draghi, the Italian prime minister, who tried to allay fears that Moscow might cut off gas supplies for heating and electricity on Wednesday.

The vulnerability of Europe’s greatest economy has already been exposed by the fact that Russia accounts for 55 percent of its gas imports, which is more than other European countries.

Ukraine’s president, Volodymyr Zelenskiy, has frequently pressed the administration to stop buying Russian gas.

At a joint press conference, Lithuanian President Gitanas Nausda stated it was time for Europe to suspend all energy commerce with Russia. According to him, the money earned from it is used to fund the invasion on Ukraine.