New Nation Report :

Despite assurances by US and its allies that the harsh economic sanctions imposed on Russia will not impact oil supplies, market players are shying away from Russian oil. Refineries that use Russian oil are having hard time opening LCs. Buyersare refusing to accept shipments unless transportation risks are borne by supplier. The rapidly changing dynamics in the global energy market may result in major price escalation of oil prices.

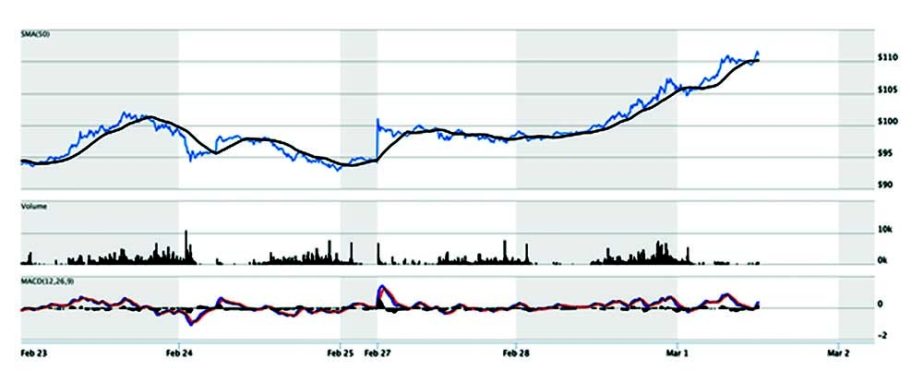

Brent oil futures, the international benchmark for energy markets, climbed over 8% to $105 a barrel on Tuesday. Prices for Russia’s flagship Urals crude rose in the other direction, indicating that demand for the country’s oil has dwindled.

However, traders are providing Urals at huge discounts—around $15 per barrel less than Brent—and yet can’t find takers according to a report by the Wall Street Journal. A reduction in the price of Espo, a popular grade of Russian crude in Asia, shows that refiners in Japan and South Korea, like those in Europe and the United States, are delaying acquisitions.

Some of the Indian oil companies are taking advantage of the circumstances by purchasing Russian oil at huge discounts. Giant, Indian oil communicated last week that it will only accept Russian oil on CFR basis, a contract term that include delivery of goods by the supplier.

Ship movements in the Black Sea, a vital oil and food export waterway shared by Russia and Ukraine on the northern side, have been halted. According to Lloyd’s List Intelligence, which tracks ship movements, more than 200 vessels are waiting to traverse the Kerch Strait, which joins the Black Sea and the Sea of Azov. Dry bulk cargo shipment declined by 62% according to various media reports.

Yesterday, oil prices surged by 7% despite US and 30 other countries announcement of intention to release 60million barrels of oil from various strategic energy reserves. The US alone will be supplying 50% from its Strategic Petroleum Reserves (SPR).

There is substantial evidence that Russian oil is quickly falling out of favor according to several energy analysts. Morgan Stanley analysts on Tuesday raised the target case of Brent to US $110/barrel. They now say that US $125 now constitute the bull case for the 2nd quarter of this year.

So far, the OPEC+ which include Russia has ignored calls by US to increase oil production to contain rapid escalation of prices globally. OPEC+ is sticking to increasing its combined output by merely 400m barrels a day every month which it has been doing for the past several months.

OPEC+ officials have communicated to Energy Intelligence, a trade journal covering the sector, that until US and its allies impose sanctions on Russian oil there won’t be further actions to increase output.

Bangladesh which depends heavily on imported oil and LNG for power generation, saw its energy bill increase by nearly 250% over the past one year just in oil component alone. LNG spot prices have waivered between US $5 to US $35+ / MMBTU during the same period in Asia. With energy prices even at current levels it is becoming challenging to keep RMG exports viable according to BKMEA.