Economic Reporter :

The country’s internet banking services have been booming amid the Covid-19 pandemic as customers have been seeking online services to protect themselves from the virus.

Banks are hoping that this new trend will encourage moving banking activities into a completely digital arena.

According to the central bank’s data, in June 2020, transactions through internet banking had increased by 12.6 percent since March.

In March, when the country diagnosed its first novel coronavirus case, internet banking transactions were Tk6,588 crore. The monthly transactions increased to Tk7,421 crore by June this year.

Bankers said people are showing more interest in having internet banking facilities as they are more practical and customers can conduct some important transactions from home or elsewhere.

Selim R F Hussain, managing director of Brac Bank, told the reporter, “During the pandemic, we saw a booming trend of using internet banking as the customers could not move freely because of the fear of the virus. We are trying to increase internet banking facilities.”

Recently, Brac Bank announced that it will enable the self-registration system to its internet banking services using credit cards as well.

As per the Bangladesh Bank’s data, from April to June, the number of internet banking users has increased by 93,560 people. And the number of total internet banking users stood at 2,742,241 at the end of June 2020.

In March, internet banking users made 18.49 lakh transactions. In June, the number of transactions increased to 22.07 lakh.

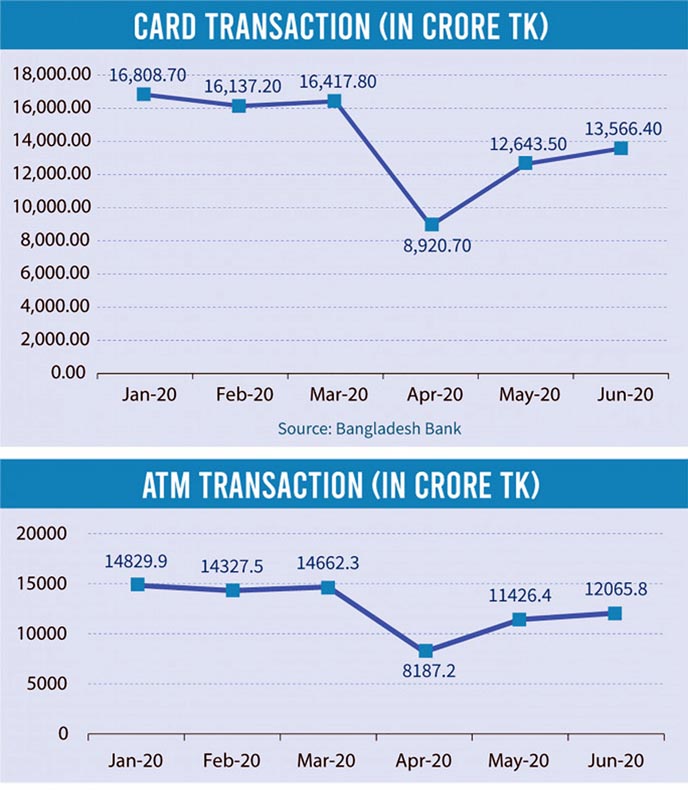

Data shows card transactions decreased around 50 percent amid the general holidays declared by the government to curb the spread of Covid-19. However, the bankers were happy because it helped them keep banking services available outside branches; which allowed them to maintain social distancing.

In April, automated teller machine transactions decreased by 44 percent compared to the previous month. In this time, point of sale transactions decreased by 68 percent.

However, e-commerce transactions increased tremendously and the trend is continuing. In March, e-commerce transactions through banks were Tk224 crore and in June they stood at Tk491 crore; which is more than double.

Mobile banking also saw an increasing trend during the pandemic. Even, in May 2020, monthly transactions in mobile banking increased to Tk47,376 crore; which is the highest monthly transactions amid the first six months of the year.

Sonali Bank Managing Director Md Ataur Rahman Prodhan said that they have increased the use of information technology in banking operations during the last five months; which had not been possible in the last five years. He identified the pandemic as the cause of the positive change.

The country’s internet banking services have been booming amid the Covid-19 pandemic as customers have been seeking online services to protect themselves from the virus.

Banks are hoping that this new trend will encourage moving banking activities into a completely digital arena.

According to the central bank’s data, in June 2020, transactions through internet banking had increased by 12.6 percent since March.

In March, when the country diagnosed its first novel coronavirus case, internet banking transactions were Tk6,588 crore. The monthly transactions increased to Tk7,421 crore by June this year.

Bankers said people are showing more interest in having internet banking facilities as they are more practical and customers can conduct some important transactions from home or elsewhere.

Selim R F Hussain, managing director of Brac Bank, told the reporter, “During the pandemic, we saw a booming trend of using internet banking as the customers could not move freely because of the fear of the virus. We are trying to increase internet banking facilities.”

Recently, Brac Bank announced that it will enable the self-registration system to its internet banking services using credit cards as well.

As per the Bangladesh Bank’s data, from April to June, the number of internet banking users has increased by 93,560 people. And the number of total internet banking users stood at 2,742,241 at the end of June 2020.

In March, internet banking users made 18.49 lakh transactions. In June, the number of transactions increased to 22.07 lakh.

Data shows card transactions decreased around 50 percent amid the general holidays declared by the government to curb the spread of Covid-19. However, the bankers were happy because it helped them keep banking services available outside branches; which allowed them to maintain social distancing.

In April, automated teller machine transactions decreased by 44 percent compared to the previous month. In this time, point of sale transactions decreased by 68 percent.

However, e-commerce transactions increased tremendously and the trend is continuing. In March, e-commerce transactions through banks were Tk224 crore and in June they stood at Tk491 crore; which is more than double.

Mobile banking also saw an increasing trend during the pandemic. Even, in May 2020, monthly transactions in mobile banking increased to Tk47,376 crore; which is the highest monthly transactions amid the first six months of the year.

Sonali Bank Managing Director Md Ataur Rahman Prodhan said that they have increased the use of information technology in banking operations during the last five months; which had not been possible in the last five years. He identified the pandemic as the cause of the positive change.