Staff Reporter :

Additional 50 per cent Advance Income Tax (AIT) for having more than one car poses extra burden on individual taxpayers as well as private car owners during this pandemic situation, which causes income losses for many people.

This comes as an extra burden as BRTA has been creating 66 per cent higher AIT from owners of private car for, two years. The owner of a 1500cc capacity car who had to pay Taka 15,000 AIT for about a decade has been changed Taka 25000 AIT for 2020-2021 as well as 2021-2022 two pandemic hit years.

As per the current tax law, if anyone has more than one car (owned individually or jointly) the taxpayer has to pay additional 50 per cent more income tax for each of such vehicles from the current fiscal year (2021-22).

The new tax law has been implemented seven years after the government decided to impose 50 per cent additional tax on the owners having more than one such vehicles in the 2014-15 fiscal year.

The government incorporated the provision of collecting additional tax in the Income Tax Ordinance-1984, but the additional tax could not be collected due to complications, including absence of necessary operating system at BRTA.

In an apparent bid to control small vehicles like cars, SUVs and microbuses, which are often blamed for traffic jam in the city, and collect higher tax from affluent people, the government had taken the decision to slap more tax at that time.

“It becomes a big burden for us. The government imposed the tax at a time when our income has come down in the wake of economic slowdown cased by the Covid-19-pandemic,” Ireen Khan (not real name), a woman entrepreneur, told The New Nation on Tuesday.

Criticising the government, she said, “It tries to earn more taxes at the cost of our pain. Right now, people are not in a position to pay additional tax. But the government uses all measures to maximise tax collection. The government should plug in the loopholes in its system which causes drainage to thousands of crores of taka every year from the national exchequer.”

BRTA Chairman Nur Mohammad Mazumder could not be reached for comments.

“If a person owns a 1,500cc car, he or she has to pay Tk 25,000 annually as advance income tax (AIT) now. But if he or she has two such cars, then they have to pay Tk 37,500 as AIT for the second car. Similarly, they have to pay Tk 37,500 for the third one,” a BRTA official told The New Nation, asking not to be named.

A total of 16.81 lakh vehicles got registered with the Dhaka offices of BRTA till May this year. Of them, 4.39 are cars, SUVs and microbuses, BRTA documents show.

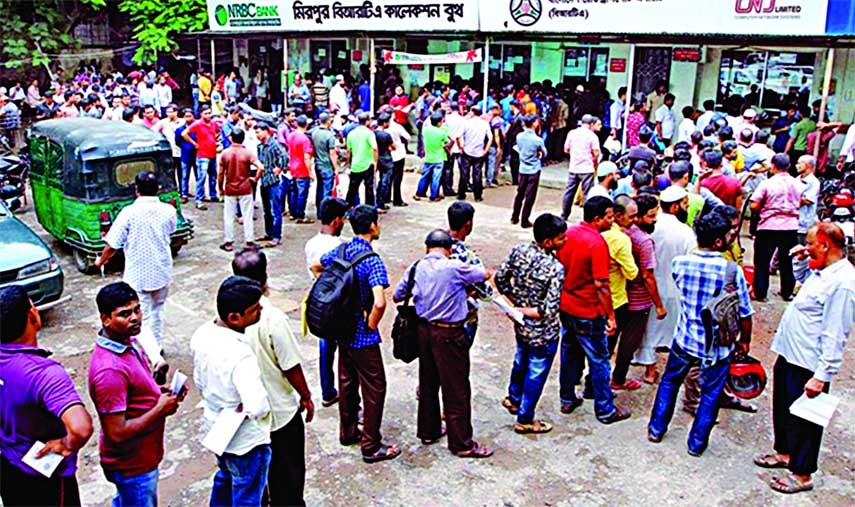

The BRTA, on behalf of the NBR, collects advance income tax from vehicle owners, thorough online banking system as the owners pay for tax token.