Special Correspondent :

Grameen Bank posted a higher net profit in 2017, thanks to increased loan disbursement, recovery and active monitoring by the head office.

“The bank earned Tk 227.53 crore net profit in 2017, up 63.35 per cent year-on-year,” Babul Saha, acting managing director of the bank, told The New Nation yesterday.

He attributed the profit for increased loan disbursement, recovery and enhanced monitoring by the head office.

The bank founded by Nobel peace prize winner Dr Muhammad Yunus, logged Tk 139.29 crore net profit in 2016.

In 2017, the bank disbursed Tk 15,000 crore loans to its one million members. The total deposit at the bank stood at Tk 14,000 crore as on 2017, according to Babul Saha.

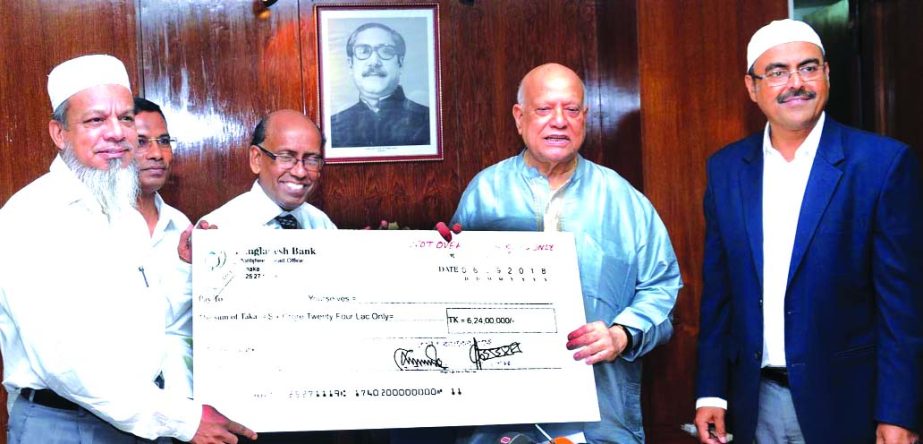

Grameen Bank on Thursday paid Tk 6.24 crore (30 per cent) in dividend for 2017 to the government for its 25 per cent stake in the bank.

As of 2017, the government received a total of Tk 31.47 crore in dividends against its total investment of Tk 21.01 crore in the bank.

“The borrower-shareholders received Tk 18 crore in dividends for 2017 against their combined investment of Tk 64.20 crore,” said Babul Saha.

He also said that the state-owned Sonali and Bangladesh Krishi Bank also received Tk 9.0 lakh each in dividend for 2017 being the shareholders of Grameen Bank.

“The bank first declared dividend in 2006 when it approved a 100 per cent dividends to its shareholders. It approved a 20 per cent dividend in the following year and from then it continues to grant a 30 per cent dividends to all shareholders,” he added.

The bank’s existing paid up capital is Tk 300 crore and Tk 1000 crore authorized capital.

Grameen Bank posted a higher net profit in 2017, thanks to increased loan disbursement, recovery and active monitoring by the head office.

“The bank earned Tk 227.53 crore net profit in 2017, up 63.35 per cent year-on-year,” Babul Saha, acting managing director of the bank, told The New Nation yesterday.

He attributed the profit for increased loan disbursement, recovery and enhanced monitoring by the head office.

The bank founded by Nobel peace prize winner Dr Muhammad Yunus, logged Tk 139.29 crore net profit in 2016.

In 2017, the bank disbursed Tk 15,000 crore loans to its one million members. The total deposit at the bank stood at Tk 14,000 crore as on 2017, according to Babul Saha.

Grameen Bank on Thursday paid Tk 6.24 crore (30 per cent) in dividend for 2017 to the government for its 25 per cent stake in the bank.

As of 2017, the government received a total of Tk 31.47 crore in dividends against its total investment of Tk 21.01 crore in the bank.

“The borrower-shareholders received Tk 18 crore in dividends for 2017 against their combined investment of Tk 64.20 crore,” said Babul Saha.

He also said that the state-owned Sonali and Bangladesh Krishi Bank also received Tk 9.0 lakh each in dividend for 2017 being the shareholders of Grameen Bank.

“The bank first declared dividend in 2006 when it approved a 100 per cent dividends to its shareholders. It approved a 20 per cent dividend in the following year and from then it continues to grant a 30 per cent dividends to all shareholders,” he added.

The bank’s existing paid up capital is Tk 300 crore and Tk 1000 crore authorized capital.