Mohammad Badrul Ahsan :

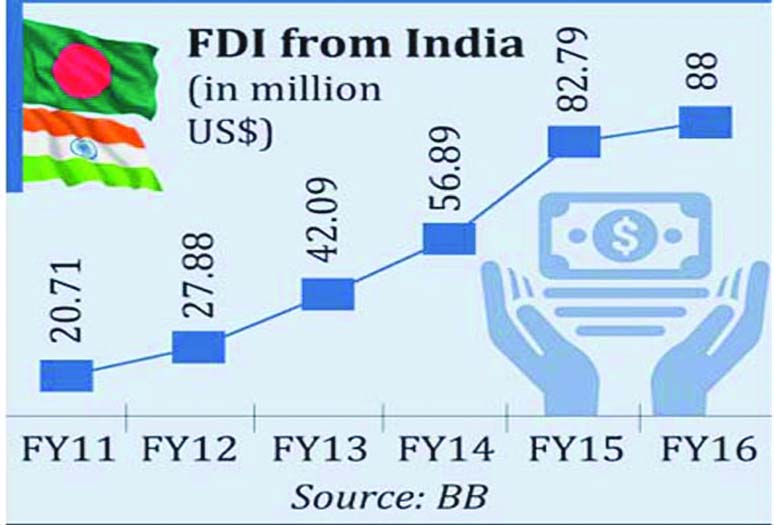

Net inflow of foreign direct investment (FDI) from the country’s next door neighbour–India increasing gradually mainly due to the better business environment and friendly relation, experts said.

In the last financial year, FDI from India increased by 6.3 per cent in the last financial year (fiscal year 2015-2016), according to the latest statistics of Bangladesh Bank.

Net FDI from India stood at $88 million in the FY16 which was $82.8 million in FY14-15.

“It is not surprising that FDI from India is increasing as best ever relation with the country is prevailing with us. We were expecting more FDI from our next door neighbour,” Dr. Mirza Azizul Islam, former Advisor to the Caretaker Government

told the New Nation.

“If the country can ensure required infrastructure and power and energy support, then the foreign investment from India would be more significant,” he added.

“Not only Indian investment, FDI would increase significantly from other countries,” Islam said.

“Despite poor infrastructure and shortage of power and energy, many foreign investors are showing interest to invest in Bangladesh mainly because of our cheep labour cost and GSP facility. So, being our next-door neighbour, it is quite necessary that FDI from the country would increase,” Dr Debapriya Bhattacharya, first Executive Director of Centre for Policy Dialogue said.

However, the central bank statistics also showed that gross inflow of FDI from India was $102.54 million in the last fiscal year while disinvestment was $14.54 million. Thus the net inflow stood at $88 million.

Of the net inflow amount, $16.31 million came as equity capital or fresh investment while $67 million came as reinvested earnings of the existing Indian entities. The rest amount worth $4.68 million came as intra-company loans.

Though FDI from India is gradually rising it is still negligible compared to total inflow of FDI worth $2003 million in Bangladesh last fiscal year.

Two major sectors, received FDI from India in the last fiscal, were: textile ($24.48 million) and banking ($23.95 million).

Stock of Indian FDI stood at $328.28 million at the end of June, 2016.

Net inflow of foreign direct investment (FDI) from the country’s next door neighbour–India increasing gradually mainly due to the better business environment and friendly relation, experts said.

In the last financial year, FDI from India increased by 6.3 per cent in the last financial year (fiscal year 2015-2016), according to the latest statistics of Bangladesh Bank.

Net FDI from India stood at $88 million in the FY16 which was $82.8 million in FY14-15.

“It is not surprising that FDI from India is increasing as best ever relation with the country is prevailing with us. We were expecting more FDI from our next door neighbour,” Dr. Mirza Azizul Islam, former Advisor to the Caretaker Government

told the New Nation.

“If the country can ensure required infrastructure and power and energy support, then the foreign investment from India would be more significant,” he added.

“Not only Indian investment, FDI would increase significantly from other countries,” Islam said.

“Despite poor infrastructure and shortage of power and energy, many foreign investors are showing interest to invest in Bangladesh mainly because of our cheep labour cost and GSP facility. So, being our next-door neighbour, it is quite necessary that FDI from the country would increase,” Dr Debapriya Bhattacharya, first Executive Director of Centre for Policy Dialogue said.

However, the central bank statistics also showed that gross inflow of FDI from India was $102.54 million in the last fiscal year while disinvestment was $14.54 million. Thus the net inflow stood at $88 million.

Of the net inflow amount, $16.31 million came as equity capital or fresh investment while $67 million came as reinvested earnings of the existing Indian entities. The rest amount worth $4.68 million came as intra-company loans.

Though FDI from India is gradually rising it is still negligible compared to total inflow of FDI worth $2003 million in Bangladesh last fiscal year.

Two major sectors, received FDI from India in the last fiscal, were: textile ($24.48 million) and banking ($23.95 million).

Stock of Indian FDI stood at $328.28 million at the end of June, 2016.