I am presenting the proposed revised budget for FY-2017-18:

Socio-economic Status:

We continue to make progress in all major economic indicators. As per provisional estimates of Bangladesh Bureau of Statistics, by the end of current fiscal year, our per capita income will grow to USD 1602 which was only USD 543 in FY 2005-06. During the same period, poverty and extreme poverty has been reduced to 23.2 and 12.9 per cent from 38.4 and 24.2 percent respectively. Side by side, life expectancy rate has increased from 65.4 years in 2006 to almost 72 years now which, indeed, is an indication of our inclusive development. Side by side, our position in socio-economic indicators like inequality, women empowerment, sanitation, mother and child mortality rate, population growth rate and social mobility has been strengthened further.

Electricity and Energy:

In 2009, our power generation capacity was only 4,942 megawatts. Now it has reached 15,379 megawatts. At the same time, system loss has been reduced to 9.3 percent from 15.6 percent.

In order to meet the growing demand of energy in the country, necessary steps are being taken to import LNG within the shortest possible time. Terminal Use Agreement (TUA) and Implementation Agreement (IA) have already been signed with a view to setting up a Floating Storage and Re-gasification Unit (FSRU) based LNG terminal in Maheshkhali on Build-Own-Operate-Transfer (BOOT) basis under Public-Private Partnership (PPP).Hopefully we will be able to supply gas to all industrial units by the end of 2018.

Transport and Communication Infrastructure:

As part of our strategy to expand transport and communication infrastructures in the country, construction of second Kanchpur Bridge on the Shitalakshya river, second Meghna Bridge on the Meghna river, and second Gumti Bridge on the Gumti river on the Dhaka-Chittagong Highway is in progress. In addition, Payra Bridge on the Payra river in Patuakhali and third Shitalakshya Bridge on the Shitalakshya river in Narayanganj are also under construction. Besides, 60 narrow and damaged bridges and culverts have been re-constructed on the highways of the western part of the country. In the current fiscal year, under 10 zone-based district highway development projects, 1,595 km long district highways have been restored, repaired and re-constructed throughput the country. As of March 2017, 41 percent of physical progress has been achieved in the construction of the long awaited Padma Multipurpose Bridge. The Bridges Division firmly believes that construction of the bridge will be completed by 2018.

Information Technology:

In order to expand ICT education, ‘Sheikh Russel Digital Lab and Multimedia Classroom’ has been established in 23,331 secondary schools and 15,000 primary schools across the country. The e-Filing system has already been introduced in 20 ministries/divisions including the Prime Minister’s Office, 64 deputy commissioner’s offices and 7 divisional commissioner’s offices. Apart from this, around 18,500 government offices throughout the country have been brought under a single network. The existing capacity of the submarine cable has been increased to 200 gbps from 44 gbps. As of April 2017, the number of mobile telephone and internet subscribers has increased to around 13.31 crore and 7 crore respectively.

Education:

You are well aware that we have so far nationalized 26,193 primary schools. As a result, almost every village of the country now has a public primary school. In the secondary level, Upazila ICT Training and Resource Centres have been established and 295 non-government schools have been transformed into model schools in 315 upazilas having no government schools. Computer labs in 3,550 educational institutions and multimedia classrooms in 23,331 educational institutions have also been set-up. From 01 July 2016, house rent and medical allowances of teachers and staffs of non-government educational institutions have been increased. Construction of new buildings for 1,500 non-government colleges, 3,000 non-government schools and 1,000 non-government madrassas is underway. Like past years, in FY 2016-17 around 38 lakh students from 6th grade to bachelor degree (pass) and equivalent level have been provided with stipends and other assistances amounting Tk. 675.38 crore.

Health:

To make healthcare readily available in rural areas, 13,339 community clinics have been set-up. Maternal Health Voucher scheme for poor, vulnerable and critically pregnant women has been introduced in community clinics of 53 upazilas. Besides, emergency pregnancy support service has been strengthened in 132 upazilas. All districts and 418 upazilas have been brought under mobile phone healthcare service. As many as 43 hospitals have been brought under telemedicine service.

A round the clock call center named Shastho Batayan”(Health Window) has been launched which will provide 24 hour health advice free of cost to the people.

Social Security:

As part of our continuous efforts to strengthen social security services, we are operating 4 Drop-in-Centers (DIC), 2 Emergency Night Shelters (ENS), 16 Child Friendly Spaces (CFS) and 3 Open Air Schools (OAS) for street children in Dhaka and Barisal. A centralized call center has been established in the Social Welfare Directorate to run Child Helpline “1098?. Through this helpline, necessary services are being provided to vulnerable, helpless and destitute children across the country.

A total of 103 care and service centers for physically challenged people have been set up in 64 districts and 39 upazilas. These centers offer a variety of cost free services and products to autistic children/persons and other physically challenged people. Let me mention here that the daughter of the Hon’ble Prime Minister Sayma Wazed has made us proud by receiving the Excellence Award from WHO for her contribution in treatment of and in healthcare services for autism. Particularly in remote areas, through 32 mobile therapy vans cost free services are being provided to disabled persons including the autistic ones. Furthermore, efforts are underway to bring social security services under automation. The data of 32.35 lakh beneficiaries of different social security services have already been recorded in a database.

Environment and Climate:

In FY 2016-17, 44 new and 2 revised projects have been adopted under the ‘Climate Change Trust Fund? which has been established with the government’s own resources. We are formulating a Road Map to develop “National Adaptation Plan (NAP)? in a bid to adopt comprehensive and long term adaptation strategy and actions against climate change. The Biodiversity Act, 2017 has been enacted which has strengthened Bangladesh?s position as a signatory of Now I would like to present the proposed revised budget for FY 2016-17.

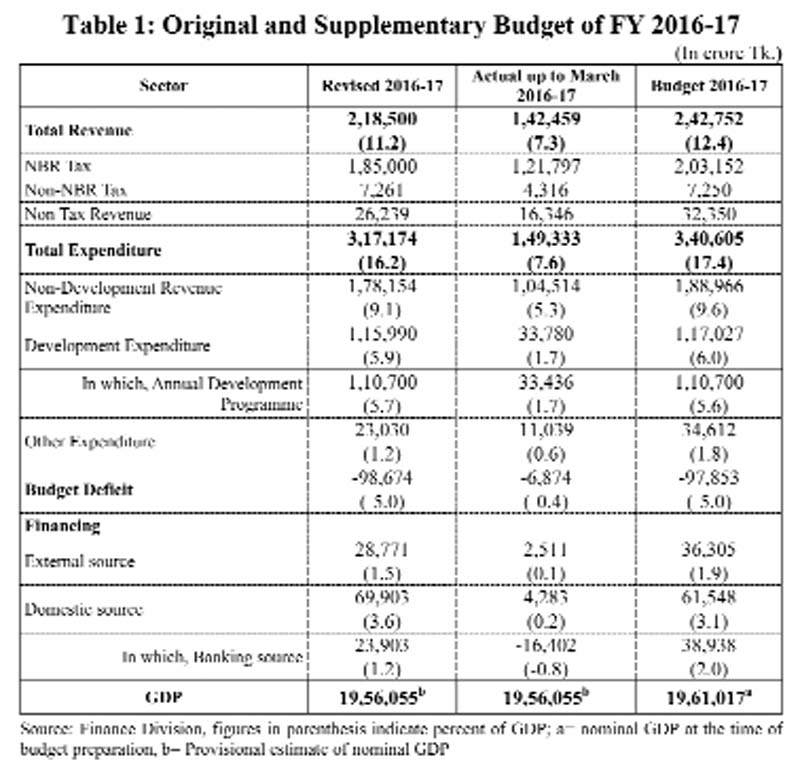

Revised Revenue Income:

In the budget of FY 2016-17, the revenue collection target was set at Tk. 2,42,752 crore (12.4 percent of GDP). Taking the state of revenue collection during July-February of this fiscal year into consideration, this target has been re-fixed at Tk. 2,18,500 crore (11.2 percent of GDP). The targets of revenue income from non-NBR and non-tax sources have undergone a downward revision to reflect less than expected revenue from these sources. In the case of NBR revenue, income and profit taxes as well as local level Value Added Tax were not realized as expected.

Revised Expenditure:

In the budget of current fiscal year, total government expenditure was estimated at Tk. 3,40,605 crore (17.4 percent of GDP). In the revised budget, it has been decreased by Tk. 23,430 crore and projected at Tk. 3,17,174 crore (16.2 percent of GDP). Due to reduction in non-ADP spending, lower interest expenditure on domestic and foreign borrowings, and reduction in subsidy, I propose setting non-development expenditure including other expenses at Tk. 2,01,184 crore by reducing Tk. 22,394 crore. Traditionally, there is a practice of downsizing ADP in the revised budget. It is my pleasure to share with you that this is the first time in history that we have been able to keep the size of the revised ADP unchanged. I strongly believe that we would be able to implement this ADP. The revised ADP including projects of autonomous bodies and corporations now stands at Tk. 1,19,295 crore (6.1 percent of GDP).

Budget Deficit:

The budget deficit is projected to be Tk. 97,853 crore (5 percent of GDP) in the current fiscal year. In the revised budget, estimated deficit stands at Tk. 98,674 crore (5 percent of GDP). In the original estimate, funding from external sources was set to Tk. 36,305 crore (1.9 percent of GDP). In the revised budget, funding from external sources has been reduced to Tk. 28,771 crore (1.3 percent of GDP) and funding from domestic sources has been set to Tk. 69,903 crore. In the case of domestic sources, receipt from non-bank sources such as sale of savings certificate may increase substantially. As a result, bank borrowing would slightly decline. As of April, savings certificates worth of Tk. 42,098 crore were sold against the target of Tk.19,610 crore for the current fiscal year.

GDP Growth:

In FY 2015-16, our GDP growth target was 7.05 percent; however, according to the final estimation of Bangladesh Bureau of Statistics (BBS), the GDP growth rate stood at 7.11 percent. This growth rate is much better than that of comparator countries. Robust domestic demand along with recovery in external demand contributed to this growth. In the current fiscal year, our growth target is 7.2 percent. The good news is that the provisional estimate released by BBS for current fiscal year reflects a growth of 7.24 percent which is higher than our GDP growth target.

Investment:

At the end of previous fiscal year, the growth rate of private investment stood at 10.3 percent- the highest in the last 7 years. Private sector investment gathered momentum due the restoration of private investors’ confidence resulting mainly from sustained political stability, government initiatives to reduce investment impediments, and decline in interest rates, etc. In previous fiscal year, growth of public investment was somewhat sluggish, however, I believe this stagnation will soon disappear with accelerated implementation of annual development programme.

Inflation:

Fuel price is current rising in the international market. Despite this inflation in Bangladesh has been declining steadily. By the end of March 2017, 12-month average inflation rate stood at 5.39 percent, compared to 6.10 percent in the same period last year. I believe that, at the end of current fiscal year the food and non-food inflation rates will remain within the target as a result of macroeconomic stability, supportive fiscal and monetary policy, satisfactory agricultural production despite loss of agricultural crop in the haor region due to flash floods, and improved domestic supply system.

Money and Credit:

By the end of March this year, growth rate of broad money supply stood at 13.08 percent, which is slightly lower than the target set by Bangladesh Bank. On the other hand, reserve money experienced 18.98 percent growth, which is slightly higher than the target. Growth of total domestic credit has slowed down due to decline in public sector borrowing. However, growth of private sector credit flow is much closer to the target. Besides, the flow of agricultural and industrial credit remains uninterrupted.

Interest Rates:

The efficiency of financial intermediation is increasing gradually as a result of various initiatives taken by the government and the Bangladesh Bank. Consequently, interests on deposits and loans continue to decline. At the same time, interest rate spread is also shrinking. At the end of March 2017, the rate of interest on deposits and loans dropped to 5.01 and 9.70 percent respectively, and the interest rate spread decreased to 4.69 percent. I believe with sustained discipline in the financial sector, this rate will decrease further in future.

Exchange Rate:

The nominal exchange rate of Taka against US dollar has remained stable for a long time. Recently, demand for dollar increased slightly due to increase in import expenditure and other factors. As a result, Taka has slightly depreciated against dollar. However, the exchange rate of Taka with respect to Yuan, Euro, Kuwaiti Dinar, Ringgit and Pound has slightly appreciated.

Imports and Exports:

Exports registered 3.92 percent growth till April of current fiscal year. During this period, the total export earnings stood at around US$ 29 billion which is around 78 percent of the annual target of US$ 37 billion. Multifarious adverse conditions in international market have created slight pressure on RMG export. Of the two major export destinations, export to the European Union has improved significantly. I believe export to the US market will also increase considerably with accelerated economic recovery in the US. Till March of current fiscal year, growth of import payments stood at 11.07 percent, compared to 7.02 percent at the same period in the last fiscal year. Growth of imports was mainly triggered by the existing momentum of domestic demand. During this period, growth of both import LC opening and rate of settlement were quite satisfactory. Especially, there has been significant increase in the import of capital machineries, which is indicative of increasing production capacity in the days ahead.

Remittance Income:

In the first ten months of the current fiscal year, remittance inflow has decreased by 16.03 percent, compared to the same period of last fiscal year. In fact, most of the developing countries in the world except some Latin American and Caribbean countries have experienced decline in remittance inflows during the last two consecutive years. Due to low oil prices and contractionary fiscal policies adopted by some governments, remittance inflow to South Asia from GCC countries has decreased notably. Furthermore, weak growth in countries of Europe and Russian Federation, deflation of Euro, adoption of anti-immigration policies by many countries, various hindrances in remittance transfer, relative benefits of remitting money though informal channels and controlled exchange rate policy of many countries have negatively impacted the remittance inflow.

Budget Deficit:

Budget deficit in the next fiscal year will be Tk. 1,12,275 crore, which is 5 percent of GDP. While deficit will increase slightly compared to the previous year due to increased allocations for development activities and social security sector, it is unlikely to have any negative macroeconomic impact due to robust GDP growth. Tk. 51,924 crore of deficit will be financed from external sources (2.3 percent of GDP) and Tk. 60,352 crore from domestic sources (2.7 percent of GDP). Of the domestic sources, Tk. 28,203 crore (1.3 percent of GDP) is expected to come from banking system and Tk. 32,149 crore (1.4 percent of GDP) from savings certificates and other non banking sources.

Stimulating Private Investment:

Private investment is an important driver in achieving higher growth through increased consumption demand ensuing from employment generation. Realizing this, the government has always been active in stimulating private investment. It has identified all supply side impediments to private investment and has been implementing a comprehensive plan of action to remove them.

Stimulating private investment requires a robust institutional structure. The government has, therefore, enacted the Bangladesh Investment Development Authority Act, 2016. Under this law, “Bangladesh Investment Development Authority (BIDA) ‘ has been established merging the Board of Investment and the Privatization Commission. The authority has taken various steps to remove the impediments to direct investment. It has formulated One Stop Service Act with utmost care. Under this law, BIDA will provide all inter-ministerial services required by the investors from one point. In this process, an investment proposal can be effectively completed in nine months. It will, as a result, improve Bangladesh?s position in the “Rank of Doing Business? and attract more foreign direct investment. Presently Bangladesh ranks 176th in Doing Business index. The BIDA has already formulated an action plan to move Bangladesh’s rank within 100 in next five years.

Contd on page 16Public Investment: We are always keen to increase the size of ADP and have taken various steps to ensure quality of expenditure and timely completion of projects. Monitoring of implementation of projects under 10 ministries/divisions with large ADP allocations has been strengthened through regular meetings. Besides, we have taken steps to identify the low performing projects and appoint consultants for providing expert services to resolve implementation problems. Initiative has been taken to improve coordination between the Economic Relations Division and development partners to ease fund release processes of 20 largest aid-recipient projects. We have taken steps to form a pool of project directors and provided training to improve their efficiency.

Education:

Sustainable and inclusive development is our motto. To this end, there is no alternative to human resources development. Hence, we always attach priority to investing in education. Motivated by the slogan “Shikkha Niye Gorbo Desh, Sheikh Hasinar Bangladesh” (We shall build Sheikh Hasina?s Bangladesh with education), we are taking steps for overall development of education sector.

Primary Education:

We have plans to build ICT based interactive classrooms in 503 model primary schools with a view to enhancing both capacity and quality in primary education sector. Besides, we plan to undertake two projects at the cost of Tk. 14,864 crore to create appropriate learning environment in existing and nationalized schools. In addition, we plan to set up training centre in every district to ensure fundamental literacy and provide livelihood skills, Dip-in-ed training to primary school teachers and set up ICT resource centers in primary schools. In order to increase enrollment rate and prevent drop out, all initiatives including school feeding, construction of new infrastructures and additional classroom buildings and other activities will continue as well. Besides, programmes for re-construction or improvement of dilapidated educational institutions will be taken up.

Construction of Rural Infrastructure and Development:

One of our priorities is to develop rural communication system by constructing roads, bridges and culverts, ensure supply of safe drinking water and develop sanitation system. We would like to continue this trend. To this end, we have plans that include construction of 5, 250 km new road, maintenance of 11,500 km metalled road, construction and maintenance of 32, 350 meter bridge and culvert, and construction of 82 union parishad buildings, 55 upazila complex buildings and 95 cyclone centers in FY 2017-18.

Industrial Development:

There is no alternative to industrialization in creating employment opportunities and achieving rapid economic growth. With this perception, `National Industrial Policy 2016? has been announced. In the light of this policy, we are taking steps to ensure industry-friendly environment and accelerate the momentum of industrialization. Based on the 7th Five Year Plan, we will construct 13 new buffer godowns and a Urea Formaldehyde-85 (UF 85) plant in different districts of the country for ensuring fertilizer preservation and distribution facilities.

Textile and Jute Industries: Jute, the golden fiber, is the symbol of our heritage. Jute goods go along with our culture. In order to increase public awareness about the use of jute goods, Bangladesh celebrated National Jute Day for the first time on 6 March, 2017 with the slogan ‘ Sonali Ansher Desh, Pat Ponyer Bangladesh (Golden fiber, Golden Country, Jute goods of Bangladesh).’ We would like to sustain this trend in future.

Trade Expansion:

We are working towards expanding our export market, exploring new markets and improving product quality as per demand of international market. We are constructing Bangladesh-China Friendship Exhibition Centre for creating exhibition facility for manufacturers and exporters to attract local and foreign buyers. I hope that construction of the centre will be completed by 2018 and we will be able to hold the Dhaka International Trade Fair of 2019 at this center. With a view to enhancing trade efficiency, we have a plan to undertake projects under Enhanced Integrated Framework (EIF). In addition, our ongoing activities will continue to diversify export products.

Public Financial Management: First of all, let me mention the issue of online pay fixation system for government employees. Online pay and pension fixation system for government employees has been introduced right after the announcement of the 8th national pay scale. It is a live system and its use in pay and pension fixation has been made mandatory. A database of government employees and pensioners is being created under this system. As of 29 May 2017, data of 11,23,241 government employees and 6,27,348 pensioners have been recorded in this database. With this system, it would be quite easy to determine grade and office -wise number of government employees and pensioners. We plan to introduce online submission of government employees? and suppliers? bills very soon.

The budget process is being gradually aligned with government strategies and policies and their outcomes under the MTBF system. We will further strengthen efforts to evaluate the outcomes achieved through utilization of allocated budget and the extent to which results are consistent with targets.

Pension:

155. We are committed to introducing a modern, updated and non-discriminatory system of pension by reforming the existing one. In the first phase of reforming the existing pension system, we have abolished the system of encashment of 100 percent pension, introduced the system of maintaining pension-related budget centrally under Finance Division instead of distributing among different ministries, and taken imitative to establish a separate pension office. From 1 July 2017, a government pensioner will receive gratuity on the half of his/her pension and the remaining half will be disbursed as monthly pension for the rest of his/her life. In the previous system, the amount of pension once fixed was not revised until the announcement of a new pay scale leading pensioners to receive pension at a very low rate. For the first time, we have introduced an annual increment of 5 percent on pension money, which will remove the existing disparity among pensioners in the one hand, and enable pensioners to sustain their living standards in the face of inflation.

Government pensioners are but a small fragment of the entire population of the country. That is why, we are working towards introducing a participatory universal pension system for all under the government support. The underlying goal of all these activities is to transform Bangladesh into a welfare state.

Land Management, Surveying and Record- keeping:

As before, we have continued various reform activities in order to update land management, survey and record-keeping systems. Along with inclusion of hill district land zoning, pilot programmes for implementation of digital land zoning activities and issuance of land ownership certificates in the plain districts are in progress. As of March 2017, printing of ‘Land Zoning Report and GIS Based Digital Land Zoning Map’ of 274 upazilas has already been completed.

Capital market:

In order to meet the capital needs of start-ups and new companies in the capital market, Bangladesh Securities and Exchange Commission (Alternative Investment) Rules, 2015 has been formulated. A modern surveillance system has already been installed to bring transparency in the transactions of the capital market. An initiative has been taken to establish a Small Cap Platform to facilitate capital formation of small and medium enterprises. To this end, Bangladesh Securities and Exchange Commission (Qualified Investor Offer by Small Capital Companies) Rules, 2016 has been formulated. Side by side, in order to launch a new product Exchange Traded Fund (ETF), Bangladesh Securities and Exchange Commission (ETF) Rules, 2016 has been formulated. A plan has been taken to establish a separate clearing and settlement company as part of a long-term action plan for development of capital market. Necessary Rules has already been formulated for this purpose. Besides, initiatives to find strategic partners under the demutualization law to enhance technical and professional capacities of stock exchanges will continue.

Insurance:

170. Formulation of Insurance Corporation Act is underway as part of implementing legal and administrative reforms in the insurance sector of Bangladesh. In addition, along with launching of health insurance, social insurance and “Weather Index Based Crop Insurance? for agricultural products, we will continue our efforts to enhance capacity of the insurance sector.

Statistics and Information Management:

Availability of accurate, quality and timely statistics on local, regional and national levels in formulating plans for socio-economic development of the country is of paramount importance. Keeping this objective in mind, Bangladesh Bureau of Statistics prepares and publishes accurate and reliable statistics regularly through various censuses and surveys to reflect the true state of socio-economic condition of the country. I mentioned in my previous budget speech about undertaking preparatory work for compiling GDP statistics quarterly. The good news is that we have already undertaken initial activities to compile the quarterly GDP statistics. We have succeeded in reducing lag time in publishing industrial production index from 3 months to 2 months. Moreover, for the first time, collection of data to measure district-wise poverty under household income-expenditure survey has already been completed. We have a plan to build a national Statistical Database soon to provide reliable and up-to-date information digitally in aid to formulate development plans and carry out administrative activities.

Revenue Mobilization:

In FY 2017-18 budget, the estimates of total revenue collection stand at Tk. 2,87,991 crore. Alongside, the amount of foreign assistance has been estimated to be Tk. 51,924 crore. Having some fiscal deficit, total expenditure has been estimated at Tk. 4,00,266 crore. Major portion of this target will be collected by the National Board of Revenue. There are four sources of NBR revenue which are: income and corporate tax, import and export duty, Value Added Tax (VAT) and supplementary duty.

Direct Tax: Income Tax:

In order to build an ideal tax system in the country, our government has undertaken extensive reforms in tax policy and tax administration. Our tax legislation has a deadline for filing income tax return. But it was a common practice that people would not file return within the deadline and wait for time extension. I am very glad to inform you that we have succeeded to change that culture. Last year we introduced the concept of the Tax Day like other developed nations which was widely accepted. Each year 30th November is observed as the Tax Day in Bangladesh. This is a milestone in tax compliance culture. We are happy that our other tax reform initiatives were also warmly accepted. The number of return filing and tax registration have exceeded our expectations. We are on right track in realizing the target of collecting at least 50 percent of our total tax revenue from direct taxation by the next decade. Now I am going to present the important proposals regarding direct taxes:

Tax Exemption Threshold and Tax Rate:

189. The existing tax exemption threshold is Taka 250,000 (two hundred fifty thousand) in general cases. However, the threshold was higher for special classes of taxpyers including female taxpyers. What should be the ideal tax exemption threshold is a subject of interesting and enlightening intellectual debate in our country. There should be a philosophy for determining the tax exemption threshold. Per capita income and the rate of inflation may be two important determinants in this case. In Bangladesh, tax exemption threshold is more than 200 percent of per capita GDP. In most developing countries, the ratio is about 100 percent. Besides, our inflation rate is low at this moment, point to point inflation measuring at around 5 percent only. Therefore, I propose that the tax exemption threshold will remain unchanged for the next fiscal year except that the thresold for person with disability will be Taka 400,000 (four hundred thousand) in place of Taka 375,000 (three hundred seventy five thousand). We had earlier fixed a respectable tax exemption threshold for gazetted war-wounded freedom fighters.

Corporate Tax Rate:

191. We often say that our corporate tax rate is very high. But the close examination of facts does not support this assertion. The existing tax rate for publicly traded companies is 25 percent, which is very compatible with global average (24.29 percent). Our corporate tax rate is low in various sub-regional and regional comparisons. The existing tax rate for non-publicly traded companies is 35 percent. This difference in tax rates should be maintained for encouraging the companies to be listed with the stock exchanges. A limited number of sectors including non-listed banks, non-listed mobile phone operators and cigarette manufacturing companies are paying tax at more than 40 percent rate. We plan to bring the rate down to 40 percent gradually of these sectors in future. As we are not increasing tax rate in any other areas, for the interest of the stability in revenue collection, I propose to keep the rates unchanged for the next year.

Readymade Garments:

Readymade garments sector is playing a vital role in the economic development and employment generation of the country. This sector is under manifold pressure due to adversities in the international market and claiming cash incentives along with withdrawal of withholding tax. Considering the contribution of this sector in the economic growth and employment generation, we have been providing various incentives and tax benefits for them. Withholding tax rate on readymade garments export is currently 0.70 percent and they are enjoying reduced corporate tax rate of 20 percent. I propose to reduce the corporate tax rate to 15 percent for this sector.

Environment:

Tax benefit for green factory: In order to keep the earth habitable for our next generation, we need to ensure both the sustainable development and the conservation of our environment. Our government has undertaken various initiatives for preventing environment pollution and maintaining ecological balance. We plan to integrate the issue of environment in our tax policy. In line with that, I propose to reduce the tax rate of a readymade garments company to 14 percent if the factory of such company has an internationally recognized green building certification.

Value Added Tax (VAT):

Contribution of Value Added Tax (VAT) is very important among all the sources of revenue collected by the National Board of Revenue (NBR). As expected, contribution of VAT in the Government exchequer has increased in this fiscal year also following the trend of the previous years. It has been possible due to several reform initiatives in the tax administration made by our government in the last few years, positive mindset of the taxpayers and hard work of the NBR officials. But considering the booming economic condition of Bangladesh there lies a huge potential of collecting revenue from VAT.

Installation of VAT Online Service Center:

In order to implement the new VAT Act, more than two hundred thousand taxpayer already received training on the new Act under the VAT Online project and this training program is still continuing. At the same time various comprehensive taxpayers? campaign programs have been launched across the country in order to make the general people aware of the benefits of the new Act. Moreover, as part of the implementation roadmap, NBR and its field offices arranged numerous partnership dialogues with FBCCI, MCCI, DCCI and the chambers throughout the country along with organizing meetings, workshops and seminars to inspire and educate the taxpayers. These activities involving all the stakeholders are still going on in different parts of the country. In order to create a pool of professional trainers, approxima