Direct Tax: Income Tax

Income tax is considered as an effective taxation system because it ensures social justice and equity through redistribution of income. The income tax system in Bangladesh will be made more effective to ensure the reduction of income inequality so that the benefit of economic growth and development can be distributed to all the citizens equally. We have set a target of collecting 50 percent of total NBR tax revenue from income tax by FY2021-22. By now we have made some headway in collecting income tax. Even a decade back, the contribution of income tax was only 20 percent of total NBR tax revenue; the contribution has increased to 35 percent during the tenure of our government.

To achieve Sustainable Development Goals (SDGs) by 2030 and fulfill the dream of raising the status of Bangladesh to a developed nation by 2041, we have to scale up revenue collection, in particular, income tax collection significantly.

Tax Exemption Threshold and Tax Rates

General tax exemption threshold of income of taxpayers, other than company, for the last few years was Tk. 2,50,000/-. The threshold for female taxpayers was Tk. 3,00,000/-. In addition, this threshold is higher for other special classes of taxpayers. The criteria for keeping the threshold unchanged for the last few years have remained same this year as well. In developed countries, tax exemption threshold of income is generally less than 25 percent of per capita income. Some countries even do not have any threshold limit. In developing countries, it is mostly equal to or below per capita income. In Bangladesh, the tax exemption threshold is almost 1.5 times above the per capita income. Moreover, any increase in the tax exemption threshold will push a significant number of taxpayers out of the tax net, which will eventually erode the tax base. The tax rates for all types of taxpayers except company have remained unchanged during the last few years. The taxpayers got habituated with this rate of tax. Considering all these, I propose that the tax exempted income threshold and tax rate for all taxpayers except for company will remain unchanged for the next year.

Existing minimum tax for a taxpayer, except company taxpayer, residing in Dhaka North City Corporation, Dhaka South City Corporation and Chittagong City Corporation, any other city corporation, and other areas is Tk. 5,000, Tk. 4,000, and Tk. 3,000 respectively. I propose to maintain this structure of minimum tax for the next year as well.

Company Tax Rate

Currently multiple corporate tax rates are in existence for different corporate sectors. For publicly traded company, tax rate in Bangladesh is

25 percent and for publicly non-traded company tax rate is 35 percent. Besides, a good number of corporate sectors are enjoying reduced tax rates and tax exemptions. When these facts are taken into consideration, we find the effective corporate tax rate in Bangladesh is below 5 percent. In addition, the tax rate for banks and financial institutions was reduced by

2.5 percent from last year, which resulted in significant reduction of tax collection from this sector. Considering the facts, I propose to continue with the existing corporate tax rate structure for the next year. Nonetheless, in view of reality, I propose to raise the minimum tax for mobile companies to 2% of their turnover from 0.75%.

Equity and Fairness

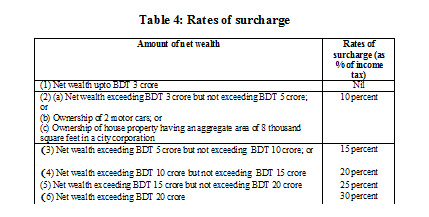

Surcharge: At present, wealth tax law does not exist in Bangladesh. Instead of paying wealth tax, wealthy individual taxpayers in Bangladesh pay surcharge at certain rates based on their income tax. This provision of surcharge has been in force for the last few years. We have observed that a large number of wealthy people show little income in their tax returns despite they possess huge amount of wealths. Consequently, they pay an insignificant amount of surcharge because their revealed little income. Considering all these facts, I propose an individual taxpayer having a net wealth of Tk. 50 crore or above shall pay higher of 0.1% of net wealth or 30% of his income tax payable as surcharge. Currently surcharge applies to taxpayers having net wealth above Tk. 2.25 crore. I propose to raise the limit of surcharge to Tk. 3 crore.

I propose a minimum surcharge amounting to Tk. 3,000, where net wealth of an individual exceeds Tk. 3 crore and a minimum surcharge amounting to Tk. 5,000 for individuals who have net wealth exceeding Tk. 10 crore. In addition, 2.5 percent surcharge on the profit of the business of the manufacturers of cigarette, bidi, zarda, gul and other tobacco products will remain unchanged.

Facilitating business and growth

The income generated through production of goods and services in Economic Zones and High-Tech Parks has been given tax exemption facilities at different rates for 10 years. With a view to driving up more investment and create more employment, I propose a new provision in the income tax law, to accept investment in Economic Zone and High-Tech Parks, without any question on the sources of invested fund, by the income tax department, if the taxpayer pays 10 percent income tax on such invested amount. At present, Income Tax department does not raise any question about the sources of fund invested in the purchase or construction of any apartment or flat, and building if tax is paid at certain rates on such investments. Taxpayers are not availing this opportunity due to the higher tax rates. I propose to decrease existing tax rates to encourage the taxpayers for voluntary disclosure of purchase or construction of any apartment or flat, and building in their tax returns. I hope that taxpayers will avail this opportunity and will voluntarily reveal their undisclosed investment on purchase or construction of apartment or flat, and building in their tax files to include them into the tax net.

Under the existing law, 21 industrial sectors and 19 physical infrastructure development sectors have been enjoying tax holidays on the basis of geographical locations at different rates for different periods of time. This benefit will expire on 30 June of this year. With a view to promoting business and investment, augmenting export and creating employments, I propose the facilities of tax holiday to continue and also to include some potential manufacturing sectors such as agricultura machinery; furniture; home appliance – rice cooker, blender, washing machine etc.; mobile handset; toys; leather and leathergoods; LED television; plastic recycling.

A taxpayer has to pay tax in advance if the taxpayer’s last assessed income is above Tk. 4 lakh. I propose to raise this to Tk. 6 lakh. On the other hand, currently small and medium enterprises (SMEs) are not required to pay income tax if the yearly turnover of the business is up to Tk. 36 lakh. To promote SMEs, I propose to raise this yearly turnover limit to Tk. 50 lakh. In the existing law, income derived from the export of handicrafts is also exempted from tax. This exemption will expire on June 30, this year. To promote this sector, I propose to extend this exemption facility for the next five years.

The tax rate for readymade garments is 12%. The rate is 10% if there is green building certification. Besides, for textile sector tax rate is 15%. These sectors are enjoying reduced rates of taxes for a long period of time. This advantage will expire by 30 June of this year. Considering the contribution of these sectors to our economy, particularly in boosting export and generating employment opportunities, I propose to continue this provision of reduced rate of taxes for these sectors.

Incentives for the share market

Investors expect cash dividends from their investment in the shares of a company. From that point of view cash dividend play an important role in increasing the value of the share and also strengthening the share market. But we observed that the companies are generally distributing stock dividend instead of cash dividend. As a result, investors are deprived of their well deserved return. In order to encourage the distribution of cash dividend, I propose imposition of 15 percent tax on stock dividend distributed to the shareholders by any listed company.

At present, dividend up to Tk. 25,000 received from the publicly traded company is exempted from tax. With a view to incentivizing the small investors and strengthening the capital market I propose to enhance this limit up to Tk. 50,000. However, this exemption will only be applicable for the individual taxpayers.

Value Added Tax

Value Added Tax (VAT) is a modern indirect tax system. It is the single highest contributor to the NBR tax revenue. Reform initiatives, positive mindset of the taxpayers and hard work of the NBR officials have contributed to this achievement. Considering the growth of the national economy, demand, interest of the business community and the consumers I am now placing before this august House the VAT related proposals for creating taxpayer-friendly, revenue-friendly and development-friendly tax structure:

The new Value Added Tax and Supplementary Duty Act, 2012 has been formulated in line with the international best practices. It will make a significant improvement in the “ease of doing business” index. Now, I am presenting some of the salient features of the new law:

a) Taxpayers will have the opportunity to get online service for VAT and Turnover Tax registration, tax payment, return submission, refund etc;

b) The existing price declaration system before the supply of goods will be abolished. The taxpayers will pay VAT on the basis of fair market price;

c) Currently there is a provision to maintain sufficient balance in the Account Current Register while supplying the goods. However, according to the new law, there is no such provision and the businessmen will be able to pay tax at the end of the month through the VAT returns;

d) Wherever 15 percent VAT is applicable, the input tax credit can be obtained through the VAT return;

e) Return will be treated as the application of refund.

As a gesture of our respect to the demands of our investors and business community, I am now proposing few reforms and simplifications in the new law to make it more time-befitting and business-friendly:

a) Exempt the small and marginal traders with an annual turnover up to Tk. 50 lakh to keep them out of the VAT net;

b) Encourage the small and medium sector (SMEs) by giving opportunity to pay turnover tax at 4 percent rate in the case of annual turnover from Tk. 50 lakh to Tk. 3 crore;

c) The VAT registration threshold has been increased to Tk. 3 crore from Tk. 80 lakh;

d) There are 3 schedules in the existing law. Exempted goods are listed in the first schedule, exempted services are listed in the second schedule and goods on which supplementary duty is leviable are listed in the third schedule. Whereas, under the new law, exempted goods and services are listed in the first schedule, goods on which supplementary duty is leviable are listed in the second schedule and goods and services on which either reduced rate of VAT is applicable or specific tax is imposed are listed in the third schedule;

e) Along with the standard VAT rate of 15 percent, there will be reduced rates of 5 percent , 7.5 percent and 10 percent for specific goods and services;

f) Considering the possibility of inflation, specific taxes have been fixed for some specific products and services;

g) The VAT rate has been fixed at 5 percent for the local traders;

h) As a special measure, considering the sensitivity of the product, the rate of VAT at the trading stage of pharmaceutical and petroleum products shall be 2.4 percent and 2 percent respectively;

i) As the new law is online-based, it will be mandatory for the shop owners and business entity to keep records of VAT challan/invoice during sales/supply through Electronic Fiscal device (EFD) and Sales Data Controller (SDC);

j) To make the new law easy, simple and more business-friendly, several amendments, corrections and additions to the Value Added Tax and Supplementary Duty Act, 2012 have been proposed;

k) In line with the changes in the law, some necessary amendments and modifications of the Value Added Tax and Supplementary Duty Rules, 2016 have also been proposed.

I am proposing to continue the existing VAT exemption facility in the case of government’s priority and fast track projects, such as the Bangladesh Economic Zone (BEZA) and the Public-Private Partnership (PPP) projects. In addition, I am also proposing to continue existing VAT and supplementary duty exemptions given to the heavy industries like automobiles, refrigerators, freezers, air conditioners, motorcycles, mobile industries, etc. for the growth and development of heavy domestic industry and export sector.

The government is following the principle of increasing the VAT net, reducing the exemptions gradually, keeping inflation under control and developing the local industry. For the sake of public interest and for the development of our local industry now I am placing a few proposals before this august House for VAT exemptions for FY2019-20, which are as follows:

a) Considering the interest of poor and marginalized people, I am proposing to provide VAT exemption on the production and supply of bread, hand-made biscuits and hand-made cakes up to the value of Tk. 150 per kg;

b) For incentivizing the agricultural sector, I am proposing to give exemptions on the local supply of agricultural machineries such as Power ripper, Power tiller operated seeder, Combined harvester, Low lift pump, Rotary tiller etc.;

c) Providing VAT exemption on the rent of a business showroom run by women entrepreneurs;

d) Providing VAT exemption on suppliers and electricity in Bangladesh Hi-Tech Park;

e) Providing VAT exemption on the supply of natural gas, suppliers and electricity in the case of investment in Bangladesh Economic Zone (BEZA);

f) VAT exemption for the investors of Public Private Partnership (PPP) projects on the procurement of services from construction firm, consultancy and supervisory firm and legal advisor;

g) VAT exemption for Rooppur nuclear power plant project on the procurement of services from freight forwarders, clearing and forwarding agencies, insurance companies, suppliers and banking services.

I am proposing to impose VAT on the products such as plastic and aluminum items, soybean oil, palm oil, sunflower oil, mustard oil etc. which have been enjoying the exemption benefit for a long time. I am also proposing to impose VAT on astrologists, marriage media services and on supply of entertainment programmes, serials, drama, telefilms etc to be broadcasted in the television channels and online media like YouTube and Facebook. In addition, I am also proposing to impose VAT at the import stage on telecom equipment as they have been enjoying exemptions for a long time.

To reduce the use of non-essential commodities and to protect the interest of the domestic industry I am proposing to impose supplementary duty on the following products and services:

(a) In order to improve the traffic congestion situation and develop the public sector transport system, 10 percent supplementary duty on issuance or renewal of all kinds of vehicles registration, route permit, fitness certificates, ownership certificate etc. except for passenger buses, trucks, lorries, three wheeler, ambulances and school buses may be imposed;

(b) Chartered aircrafts and helicopters have become popular means of transportation among the very rich people. Therefore, I am proposing to increase the existing supplementary duty from 20 (twenty) percent to 25 ( twenty five) percent on this service;

(c) Imposition of 5 percent supplementary duty on ice-cream;

(d) To increase the supplementary duty from 5 percent to 10 percent of the services provided through mobile phone SIM / RIM card.

Considering the health-risk and harmful effects of tobacco products and to maintain compliance with global anti-smoking policy, we are committed to reduce the use of tobacco and maximize revenue collection from this sector:

(a) I am proposing to fix the price of every 10 sticks of low segment cigarette at Tk. 37 and the supplementary duty rate at 55 percent. I am also proposing to fix the price of every 10 sticks of the medium segment cigarette at Tk. 63 and the supplementary duty rate to 65 percent while fixing the price of every 10 sticks of high segment and premium segment cigarette at Tk. 93 and Tk. 123 respectively and keep the supplementary duty rate to existing 65 percent.

(b) I am proposing to fix the price of 25 sticks of non-filter bidi at Tk. 14 and supplementary duty rate at 35 percent and to fix the price of 20 sticks filter bidi at Tk. 17 and supplementary duty rate at 40 percent.

(c) Smokeless tobacco like Zarda and Gul are another two health- hazardous items like cigarette and bidi. The detrimental impacts on health from consuming these items are even greater since these items are directly consumed. In order to reduce the consumption of smokeless tobacco products, I am proposing to fix the minimum retail price at Tk. 30 per 10 grams from zarda and Tk. 15 per 10 grams for gul and fix the supplementary duty rate at 50 percent.

Import-Export Duty-Taxes

In addition to collect correct revenue, simplification of trade is also very important. In accordance with the previous steps taken by the present government for the sake of continuing growth of our domestic economy, we have invited budget proposals from all stakeholders for liberalization and more rationalization of duty-tax structure for strengthening the worldwide ongoing trade liberalization and the role of local industry in our economy. With a meticulous scrutiny of 2,125 proposals received from different stakeholders and evaluation of these suggestions, I am placing the proposals through you before this august parliament for the protection of local industry, trade and consumers interest.

Following factors have been reviewed in considering the proposals received from the stakeholders regarding import duty, regulatory duty, supplementary duty and Value Added Tax:

” Assist the investors and businessmen for creating investment friendly environment;

” To provide incentives for export oriented backward & forward linkage industries;

” To provide policy support for the development of ICT sector;

” To maintain consumer’s right and to keep the price of the essential goods at reasonable level;

” To develop and protect local industries in agriculture, health, leather, textile, fishery and livestock;

” To rationalize tariff structure by following the principle of equity and justice;

” To formulate policy for Sustainable Development Goals (SDG) and to increase internal revenue collection;

” To upgrade Bangladesh’s position in Ease of Doing Business index;

” To prevent smuggling, mis-declaration and misuse of bond facilities.

I propose existing 06 (six) slabs of Customs Duty (0%, 1%, 5%, 10%, 15%, and 25%), 3% Regulatory Duty on goods having highest import duty, and existing 12 (twelve) slabs of Supplementary Duty (10%, 20%, 30%, 45%, 60%, 100%, 150%, 200%, 250%, 300%, 350%, and 500%) on import stage to continue in FY2019-20. Besides, existing 0% import duty will remain unchanged for importing essential goods like lentils, wheat, onion, edible oil, fertilizer, seed, raw cotton and raw materials for some industries. Existing 0% rate will also remain same for importing life savings drugs and medical equipment. However, for the protection of local farmers, existing highest rate of customs duty at 25% and recently imposed 25% regulatory duty will remain unchanged on rice import.

Agriculture sector:

Agricultural sector is a priority sector in Bangladesh. Zero rates are proposed to be unchanged for the prime ingredients of agricultural sector, especially for fertilizer, seeds, insecticides. Concessionary rate of duty will be continued for agricultural equipment and spareparts.

Fish, Poultry and Dairy: Fish, Poultry and Dairy is one of the most important subsectors of agriculture. Government has been providing some tax benefits and incentives to this sector for the last few years. To ensure sustainable development in this sector, I propose these tax incentives and exemptions should continue and extend this benefit to some new raw materials and equipment.

Industrial sector:

Industry is now the second largest sector in terms of contribution to the GDP. This contribution of the industrial sector is increasing day by day. Moreover, this sector is highly contributing to employment generation and investment. Our present development strategies comprise of the following elements: driving up industrial investment, maximizing utilization of the installed capacity of the existing industries, making export-oriented industries more competitive through its diversified expansion.

Milk Powder: At present, milk powder is importable on a concessionary Customs Duty (CD) rate which is 5%. To protect local dairy industry, I propose to increase this 5% CD to 10% on milk powder import.

(1) Sugar: I propose to increase existing specific duty from Tk. 2000.00/MT to Tk. 3000.00/MT on import of raw sugar. For refined sugar the specific duty will be increased from Tk. 4,500.00/MT to Tk. 6,000.00/MT. Regulatory duty will be 30% instead of 20% for both refined and raw sugar import.

(2) Medicine: The quality of medicine produced in Bangladesh is internationally acclaimed. It is one of the highly prospective export sectors in Bangladesh. We have a steep growth in medicine exports and that has been possible as the sector gets necessary facilities and required protection from the government. Exemptions and concessionary rate of duties of some pharmaceutical raw materials including that of cancer medicines, have been proposed. Moreover, I propose to decrease regulatory duty from 20% to 10% on import of liquid Oxygen, Nitrogen, Argon and Carbon Dioxide for making these lifesaving gases available to the poor patients at low cost.

(3) Other Industries: To protect domestic industries, I propose to increase regulatory duty on Maize (corn) starch, Manioc (Cassava) starch and gypsum board import. I also propose to increase supplementary duty on import of particle board and domestic electrical articles. Moreover, I also propose to allow import of some essential raw materials of lift, refrigerator, compressor, air conditioner, electric motor, mold and footwear industries at a concessionary rate.

(4) Export Duty: Rice bran is the prime raw material of rice bran oil. As there is a huge demand from local rice bran industries, I propose to increase export duty of rice bran from 10% to 25% to discourage exports. I also propose to withdraw existing 10% export duty on unmanufactured tobacco and to decrease existing export duty of building bricks from 25% to 15%.