Kazi Zahidul Hasan :

Bangladesh’s LNG import bill will be doubled at the end of this year thanks to skyrocketing prices of the super-chilled fuel in the international spot markets.

The LNG (liquefied natural gas) import bill will reach over Tk 40,000 crore at the end of fiscal year 2021-22 as its prices have lurched from record lows to record highs, an official of Bangladesh Oil, Gas and Mineral Corporation, commonly known as Petrobangla,told The New Nation yesterday on condition of anonymity.

He said, “Petrobangla it is now under pressure to finance the LNG import bill as the state-owned entity has been facing liquidity crisis due to non-availability of funds from the government. A large sum of funds which the Petrobangla is supposed to get as subsidy is yet to be released.”

“Petrobangla will be able to finance the LNG import bill up to middle of March this year. After that period it will loss the capacity to make payment against LNG import unless the government injects fresh funds to the cash-strapped state-owned entity,” said the Petrobangla official.

The total LNG import bill stood at Tk 19,506 crore (including VAT and AIT) at the end of fiscal year 2020-21.

Petrobangla earned Tk 14,880 crore from LNG trade and it incurred Tk 2,812 crore losses for selling the gas at subsidized rates in domestic market.

Officials said, currently, Petrobangla imports LNG from long-term suppliers at US$11.5 for per million British thermal units (MMBTU) while it imports LNG from spot market at US$29 to US$30.

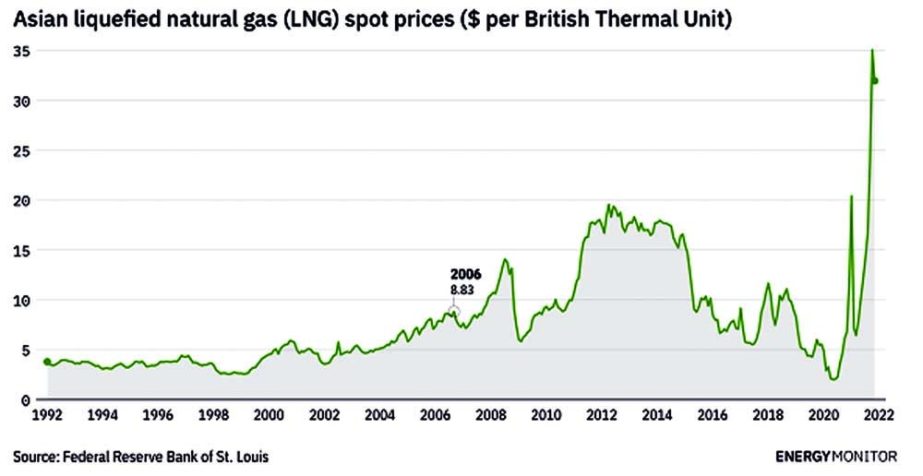

Spot LNG prices have increased to US$30 per MMBTU in October 2021 from under US$2.0 in May 2020, while the LNG prices for long-term deal reached near US$12 from US$ 3.5 in January last year.

“LNG prices has already hit record level on the international market amid growing global demands for natural gas following global economic recovery from the Covid-19 pandemic. Besides, Bangladesh continues to import the costly fuel to meet the demand-supply gap of the natural gas in the country.”

The country’s natural gas output is currently hovering around 2,840 million cubic feet per day (mmcfd). At present, two floating storage and regasification units are supplying around 722 mmcfd of gas to the national grid, said aPetrobangla official.

Even sitting idle, government has to pay over USD 200,000.00per day ($159,186 a day as rent for the floating terminal, $45,814 a day as operational charge and $32,000 for port services for Excelerate) for rent and operational expense coverage to each of two the LNG terminal providers, namely Summit LNG Terminal Co. Singapore, a concern of Summit Group Bangladesh and Excelerate Energy of USA.

Meanwhile, finance ministry officials said import of LNG poses a heavy burden on the national exchequer as surge in the global gas prices dramatically increasing the import bill as well as demand for energy subsidy.

Recently, the Energy Division sought Tk 32,219 crore from the Finance Ministry as subsidy against import of expensive liquefied natural gas acting on a Petrobangla proposal in this regard.

“We have received the proposal but yet to take any decision in this regard,” said a Finance Division Official, adding, “It’s a huge amount….Right now the government kitty can hardly afford to allocate such a big fund when it was under pressure to finance the government’s mega development projects as well meet its day-to-day expenditure amid a slower than expected revenue collection growth.”

In the current fiscal year’s budget, Tk4,000 crore has been allocated for LNG subsidy, of which Tk1000 crore was disbursed so far.

The government provided Tk1,000 crore in LNG subsidy to Petrobangla in the fiscal year 2018-19, Tk2,500 crore in the fiscal year 2019-20 and Tk2,812 crore in the fiscal year 2020-21.

Officials said, Petrobangla will require Tk25,000 crore subsidy in the current fiscal year after selling the gas at current market price.

“The government has decided to hike gas prices to overcome the situation arises from the costly LNG import,” they added.

LNG which has long been considered a transitional fuel that bridge the void between traditional fossil/nuclear energy sources and renewables, is becoming dangerously volatile. Prices of LNG fluctuated between less than USD 5 to nearly USD 40/MMBTU in a span of just two years.

The high cost of LNG imports is distorting cost calculations of our exports such as RMG as government uses a blended pricing formula for local energy that combines local gas, local coal, imported HFO/diesel and imported LNG.