Abu Sazzad :

The disbursement of industrial term loan and its classified amount has risen in a parallel way in the last fiscal 2014-15.

Industrial term loan disbursement increased significantly in the last fiscal despite political turmoil and inadequate supply of gas and power.

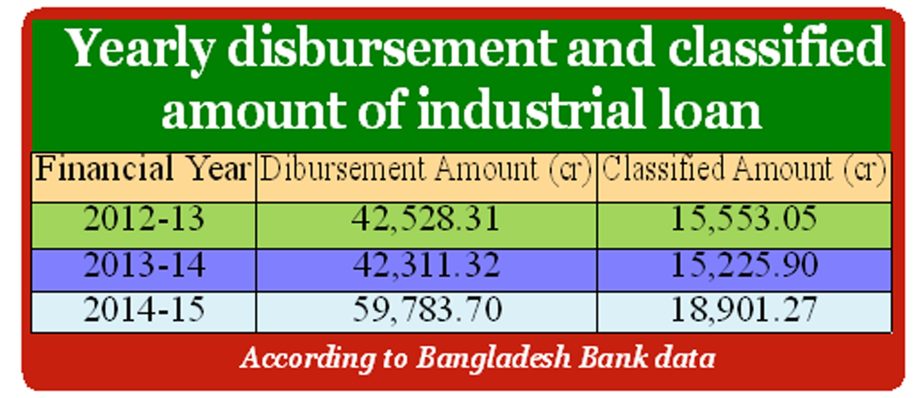

The disbursement of term loan increased by 41.29 per cent in the last fiscal 2015 compared with its previous fiscal 2014.In the last fiscal, the disbursement amount of term loan was Tk59,783.70 crore which was Tk 42,311.32 crore in the fiscal 2014, according to the latest data of Bangladesh Bank released on Thursday.

On the other hand, experts said, banks have failed to check the classified loan of industrial loan due to political unrest in the first half of the year and violation of rules and regulations by banks in loan disbursement.

Default industrial loans stood at Tk 18,901.27 crore in the FY2015, rising by 24.14 per cent from Tk 15,225.90 crore in the FY2014. The default industrial loan amount was Tk 15,553.05 crore in the fiscal 2012-13.

Most of the commercial banks have recently reduced the lending rate for industrial loan with a view to providing easy financial access to businesses, the Central Bank Executive Director M Mahfuzur Rahman told the New Nation.

“It is good news for our economy that now maximum banks are offering between 13-15 per cent interest for industrial loan which was 18-19 per cent in six months before,” said the central bank executive.

Bangladesh Bank has been encouraging private commercial banks to reduce the lending rate on industrial loan to ensure GDP growth target by increasing inflow of credit to the productive sector, he said. In the last fiscal, industrial term loan substantially declined due to prolonged political unrest, simultaneously private sector credit growth dropped significantly.

Talking on classified loan, Mahfuzur Rahman said, already the central bank has installed large loan monitoring software. He hoped that the classified loan of the term loan to decline in future due to the policy measure of Bangladesh Bank.

Talking to the reporter, Bangladesh Bank Deputy Governor Nazneen Sultana said, the liquidity position in the banking sector is now satisfactory, so the higher interest rate on the industrial loan is not desirable. ‘It is important to decrease the rate of interest on industrial loans to achieve the desired GDP growth,’ said BB Deputy Governor.

The central bank already asked banks to strengthen their risk management to check the classified loan. Recently, the central bank issued a circular in this regard. Schedule banks will face penalty if they fail to manage their risks properly as per the central bank’s guidelines, she said.

The banks will be punished if they fail to execute their own risk management related activities including limit setting as per customer’s ability, said the deputy governor.

The circular contains a set of instructions to be followed by banks for strengthening their risk management with immediate effects. Bangladesh Bank has also asked all the schedule banks to adopt a separate set of officials for the risk management division, appointing efficient manpower. As per the new rule, all the banks will have to appoint a Chief Risk Officer (CRO) equivalent to Assistant Managing Directors or Deputy Managing Director.

An officer with the rank of Executive Vice- President or Vice-President will be appointed as the head of risk management division, she said. The risk management division will set a limit of taking risk for the respective banks on annual basis, she also added.

Association of Bankers, Bangladesh (ABB) President and Managing Director of Eastern Bank Ltd, Ali Reza Iftekhar said, the defaulted loan is the key challenge for the banking sector. “We have to take initiative to reduce the non-performing loans at any cost as the classified loans will foil the capacity and reputation of a bank,” said the ABB President.

The reduction of industrial term may decrease the non-performing loan from the banking sector but this is not the solution, pointed the ABB President. “Industrial loan is very important to expand industrialization process in the country, so the credit analysts of the banks have to be cautious to set the credit limit in favor of the industrialists”, said the ABB President.

Centre for Policy Dialogue (CPD) Executive Director Mustafizur Rahman said, the industrial sector faced a major setback in last financial year due to political violence that fuelled the defaulted loans in the sector. Besides, indiscriminate loan disbursement by banks also resulted in soaring defaulted credit in the industrial sector, he claimed.

The country witnessed political unrest in the third quarter of the FY15 that ultimately put an adverse impact on the industrial loan situation; he said adding that political turmoil in 2013 and 2014 had put a long-term effect on business sector.

Due to the political instability, a good number of businessmen failed to repay installments of their loans in due time, increasing the classified loans, he said.

There was question about the disbursement process of banks loans. The classified loans in the industrial sector increased in the last fiscal as banks did not disburse the loans to the proper clients, claimed the CPD Executive.

The central bank should speed up its monitoring process to ensure the quality of loan disbursement, otherwise the defaulted loans will increase further, he suggested.

Due to an increase in non-performing loans, banks’ financial health will be vulnerable that also will weaken the corporate governance, he observed.

The disbursement of industrial term loan and its classified amount has risen in a parallel way in the last fiscal 2014-15.

Industrial term loan disbursement increased significantly in the last fiscal despite political turmoil and inadequate supply of gas and power.

The disbursement of term loan increased by 41.29 per cent in the last fiscal 2015 compared with its previous fiscal 2014.In the last fiscal, the disbursement amount of term loan was Tk59,783.70 crore which was Tk 42,311.32 crore in the fiscal 2014, according to the latest data of Bangladesh Bank released on Thursday.

On the other hand, experts said, banks have failed to check the classified loan of industrial loan due to political unrest in the first half of the year and violation of rules and regulations by banks in loan disbursement.

Default industrial loans stood at Tk 18,901.27 crore in the FY2015, rising by 24.14 per cent from Tk 15,225.90 crore in the FY2014. The default industrial loan amount was Tk 15,553.05 crore in the fiscal 2012-13.

Most of the commercial banks have recently reduced the lending rate for industrial loan with a view to providing easy financial access to businesses, the Central Bank Executive Director M Mahfuzur Rahman told the New Nation.

“It is good news for our economy that now maximum banks are offering between 13-15 per cent interest for industrial loan which was 18-19 per cent in six months before,” said the central bank executive.

Bangladesh Bank has been encouraging private commercial banks to reduce the lending rate on industrial loan to ensure GDP growth target by increasing inflow of credit to the productive sector, he said. In the last fiscal, industrial term loan substantially declined due to prolonged political unrest, simultaneously private sector credit growth dropped significantly.

Talking on classified loan, Mahfuzur Rahman said, already the central bank has installed large loan monitoring software. He hoped that the classified loan of the term loan to decline in future due to the policy measure of Bangladesh Bank.

Talking to the reporter, Bangladesh Bank Deputy Governor Nazneen Sultana said, the liquidity position in the banking sector is now satisfactory, so the higher interest rate on the industrial loan is not desirable. ‘It is important to decrease the rate of interest on industrial loans to achieve the desired GDP growth,’ said BB Deputy Governor.

The central bank already asked banks to strengthen their risk management to check the classified loan. Recently, the central bank issued a circular in this regard. Schedule banks will face penalty if they fail to manage their risks properly as per the central bank’s guidelines, she said.

The banks will be punished if they fail to execute their own risk management related activities including limit setting as per customer’s ability, said the deputy governor.

The circular contains a set of instructions to be followed by banks for strengthening their risk management with immediate effects. Bangladesh Bank has also asked all the schedule banks to adopt a separate set of officials for the risk management division, appointing efficient manpower. As per the new rule, all the banks will have to appoint a Chief Risk Officer (CRO) equivalent to Assistant Managing Directors or Deputy Managing Director.

An officer with the rank of Executive Vice- President or Vice-President will be appointed as the head of risk management division, she said. The risk management division will set a limit of taking risk for the respective banks on annual basis, she also added.

Association of Bankers, Bangladesh (ABB) President and Managing Director of Eastern Bank Ltd, Ali Reza Iftekhar said, the defaulted loan is the key challenge for the banking sector. “We have to take initiative to reduce the non-performing loans at any cost as the classified loans will foil the capacity and reputation of a bank,” said the ABB President.

The reduction of industrial term may decrease the non-performing loan from the banking sector but this is not the solution, pointed the ABB President. “Industrial loan is very important to expand industrialization process in the country, so the credit analysts of the banks have to be cautious to set the credit limit in favor of the industrialists”, said the ABB President.

Centre for Policy Dialogue (CPD) Executive Director Mustafizur Rahman said, the industrial sector faced a major setback in last financial year due to political violence that fuelled the defaulted loans in the sector. Besides, indiscriminate loan disbursement by banks also resulted in soaring defaulted credit in the industrial sector, he claimed.

The country witnessed political unrest in the third quarter of the FY15 that ultimately put an adverse impact on the industrial loan situation; he said adding that political turmoil in 2013 and 2014 had put a long-term effect on business sector.

Due to the political instability, a good number of businessmen failed to repay installments of their loans in due time, increasing the classified loans, he said.

There was question about the disbursement process of banks loans. The classified loans in the industrial sector increased in the last fiscal as banks did not disburse the loans to the proper clients, claimed the CPD Executive.

The central bank should speed up its monitoring process to ensure the quality of loan disbursement, otherwise the defaulted loans will increase further, he suggested.

Due to an increase in non-performing loans, banks’ financial health will be vulnerable that also will weaken the corporate governance, he observed.