New Nation Report :

United States President Joe Biden has imposed an immediate ban on Russian oil and other energy imports in retaliation for Russia’s invasion of Ukraine, a significant action that will further deprive President Putin of the economic resources he uses to continue his needless war of choice.

According to figures from the Russian Central Bank, Russia has exported crude oil and petroleum products worth about US $3.5 trillion since Vladimir Putin took power at the turn of the millennium. During the same time period, its natural gas exports totaled US $938 billion. Oil and gas income contributed US$123 billion to the Russian federal budget last year, resulting in a year-end budget surplus. Much of this money came from oil, which was mostly sold to the EU.

The primary beneficiaries of Russia’s oil and gas earnings have been Putin himself, few Russian generals and the oligarchs who benefited from uncontested government contracts.

As winter season ends on March 20th in Europe, the West is making some bold moves that substantially will limit influence of Putin’s oil and gas on the global economy.

This week US president Biden, banned imported oil and other energy sources from Russia to punish the country as it intensified its military campaign in Ukraine.The U.S. immediately prohibited new Russian shipments of oil, certain petroleum products, liquefied natural gas and coal under an executive order.

Washington will give companies 45 days to wind down existing contracts for Russian energy supplies, a senior Biden administration official said. The order also bars new U.S. investment in Russia’s energy sector and blocks Americans from financing foreign companies that invest in the sector.

About 8% of US imports of oil and refined products, or about 672,000 barrels a day, came from Russia last year, according to the U.S. Energy Information Administration.

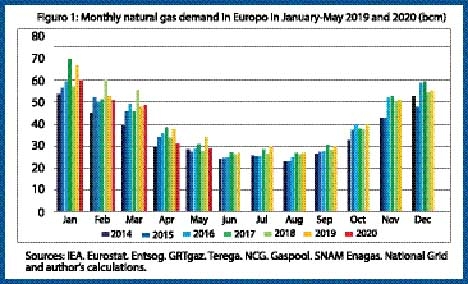

Simultaneously, The European Union, the largest customer of Russian gas, said it planned to cut its imports of Russian natural gas by two-thirds by the end of this year, while the UK said it would end Russian oil imports, currently 8% of the nation’s demand, by the end of the year.

“By the end of this year, we can replace 100 billion cubic meters of gas imports from Russia. That is two-thirds of what we import from them,” EU Commission Vice President Frans Timmermans told reporters in Strasbourg, France this week.

Shell and its FTSE 100 rival, BP, had already said they would abandon major stakes in Russian oil and gas extraction projects after pressure from the UK government. However, Shell went further on Tuesday, saying it will stop all spot purchases of Russian oil and gas, as well as shutting 500 service stations, its aviation fuels and lubricants operations in Russia.

Oil prices which have been escalating dangerously since the invasion fell by 1.2% the day after Biden’s announcement of the ban.

The alliance of 23 oil producers, OPEC+, supplies more than half of the global oil and petroleum products. OPEC+ which is co-chaired by Russian deputy prime minister has so far refused to respond to US calls to increase output. In recent weeks, leaders of Saudi Arabia and the United Arab Emirates have neglected to call US President Joe Biden as the US and its allies worked to curb a spike in energy prices caused by Russia’s invasion of Ukraine.

According to the Wall Street Journal, both Saudi Crown Prince Mohammed bin Salman and Sheikh Mohammed bin Zayed al Nahyan of the United Arab Emirates have been unavailable to Biden after US demands for talks.

Putin is also trying to torpedo the Iran Nuclear deal with last minute demands. Iran was producing 3.8 million barrels per day before imposition of sanctions.

However, according to a top US shale oil executive, together with demand destruction due to high prices and rapid electrification of the transportation, US being the largest oil producer and soon to be the largest LNG exporter, may well be able to meet a substantial part of the shortfall created by Putin’s oil and gas in the long-termeven without the help of OPEC+.