Business Desk :

The Unnayan Onneshan (UO), an independent multidisciplinary think-tank, in its February issue of Bangladesh Economic Update 2015 says that the shortfall in revenue collection in the current fiscal year vis-à-vis budgetary target may be larger than those in the previous fiscal years due mainly to current political standoff-induced sluggish economic activities.

The research organization employs two methods in estimating the shortfall in the collection of revenue in FY 2014-15. First, the shortfall in revenue collection has been estimated by taking account of the historical trend. Second, the trend in the revenue collection of the fiscal years as regards political standoff due to national parliamentary election has been taken into consideration with a view to estimating the current fiscal year’s revenue collection.

The first estimate, based upon historical trend analysis, shows that the shortfall in revenue collection vis-à-vis target may be to the tune of Tk. 26775 crore at the end of the FY 2014-15, whereas the second estimate taking the trend of political standoff fiscal years of national parliamentary elections into consideration suggests that the shortfall may be around Tk. 34000 crore.

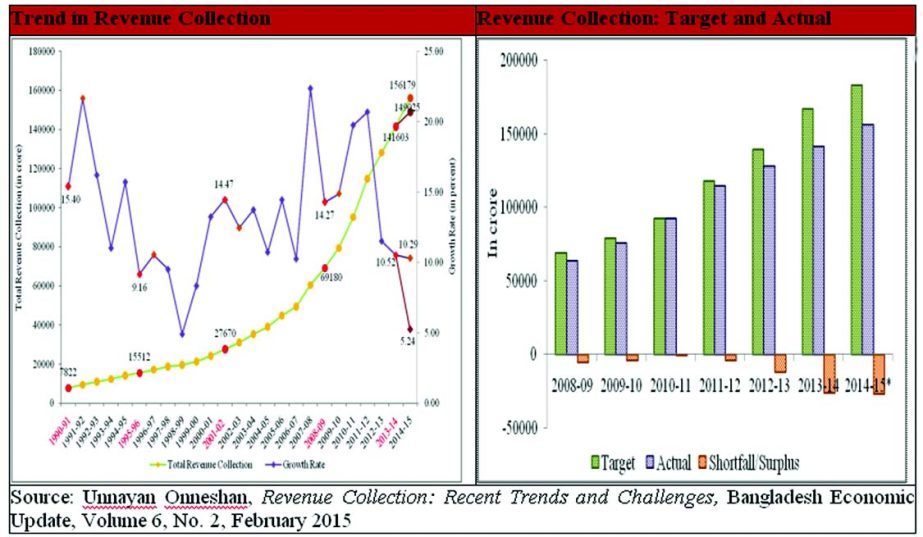

As regards the shortfall in revenue collection during the impasse years of parliamentary election, the research organisation finds that in FY 1990-91 (election held on February 27, 1991) the rate of growth in revenue fell from 16.42 to 15.4 percent and then rose to 21.67 percent in the following year when new government was formed. Similarly, in FY 1995-96 (election held on February 15 and June 12, 1996) the rate of growth in revenue collection slipped from 15.71 percent to 9.16 percent and then increased to 10.52 percent in the following year.

In the first half of the current FY 2014-15, the National Board of Revenue (NBR) has collected Tk. 59063.59 crore, which is 39.44 percent of the total target of Tk. 149720 crore for the whole fiscal year. In FY 2013-14 and FY 2012-13, the collection of total revenue, however, stood at 96 percent and 97 percent of the target respectively and therefore the gap was Tk. 25856 crore and Tk. 10847 crore respectively.

The UO, however, fears that this shortfall in revenue collection is likely to cause the budget deficit to rise to 7 percent of GDP in FY 2014-15, if the current expenditure limit is maintained, which is most unlikely because of the lower annual development expenditure, and thereby exerting immense adverse impact on country’s economic growth.

Pointing to the lag in collecting Value Added Tax (VAT), the UO finds a that the collection of VAT(local) has stood at Tk. 14683.7 crore (37.86 percent) during the first half of FY 2014-15 against the target of Tk. 38780.42 crore for the whole this year, indicating an underperformance at the end of the fiscal year.

Along the same vein, the collection of income tax, which has been envisaged in the budget as the largest source of revenue, may undergo a hefty deficit at the end of the fiscal year as well. The collection of income tax has stood at Tk. 18721 crore (33.09 percent) during the first half of FY 2014-15 against the target of Tk. 56580 crore for the whole fiscal year.

As regards the import duty, the collection reached Tk. 6965 crore (48.45 percent) during the first half of FY 2014-14 against the target of Tk. 14376.7 crore for the whole fiscal year. The collection of import duty may, however, fall during the second half of the current fiscal year due to increasing cancellation of letters of credit.

Meanwhile, the collection of non-NBR revenue has also slowed down. The collection of non-NBR tax has stood at Tk. 1407 crore (25.25 percent) during the period of June’14 – October’14 against the target of Tk. 5572 crore for the FY 2014-15. These lags in collecting taxes can be attributed to current political unrest-induced reduced business activities, adds the research organization.

During the period of July’14 – October’14, the collection of non-tax revenue decreased by 36.5 percent compared to the corresponding period of the FY2013-14. The collection of non-tax revenue has stood at Tk. 7279 crore during the period of June’14 – October’14 against the target of Tk. 27662 crore for the whole fiscal years, whereas the collection was Tk. 11464 crore during the same period of the previous fiscal year, finds the UO.

Pointing to the economy’s lagging behind other developing economies in collecting tax, the Unnayan Onneshan demonstrates that the tax-GDP ratio stood at 9.7 percent against the target of 11 percent in FY 2013-14, whereas the ratio stood at 13.9 percent and 12 percent in 2013 Nepal and Sri Lanka respectively.

Noticing the status of low ADP implementation, the think tank finds that during the first half of FY 2014-15, the implementation of ADP stands at Tk. 27305 crore that represents 32 percent of the total allocation for ADP in FY 2014-15. The research organisation, therefore, cautions that the total implementation of ADP may fall short of target at the end of the current fiscal year amidst the continued political unrest.

Against this backdrop of gaps in collecting revenue, the Unnayan Onneshan urges for an inclusive political dialogue amongst the political parties to reach solutions that would boost the business activities in the economy and thus foster the collection and mobilisation of revenue.

The Unnayan Onneshan (UO), an independent multidisciplinary think-tank, in its February issue of Bangladesh Economic Update 2015 says that the shortfall in revenue collection in the current fiscal year vis-à-vis budgetary target may be larger than those in the previous fiscal years due mainly to current political standoff-induced sluggish economic activities.

The research organization employs two methods in estimating the shortfall in the collection of revenue in FY 2014-15. First, the shortfall in revenue collection has been estimated by taking account of the historical trend. Second, the trend in the revenue collection of the fiscal years as regards political standoff due to national parliamentary election has been taken into consideration with a view to estimating the current fiscal year’s revenue collection.

The first estimate, based upon historical trend analysis, shows that the shortfall in revenue collection vis-à-vis target may be to the tune of Tk. 26775 crore at the end of the FY 2014-15, whereas the second estimate taking the trend of political standoff fiscal years of national parliamentary elections into consideration suggests that the shortfall may be around Tk. 34000 crore.

As regards the shortfall in revenue collection during the impasse years of parliamentary election, the research organisation finds that in FY 1990-91 (election held on February 27, 1991) the rate of growth in revenue fell from 16.42 to 15.4 percent and then rose to 21.67 percent in the following year when new government was formed. Similarly, in FY 1995-96 (election held on February 15 and June 12, 1996) the rate of growth in revenue collection slipped from 15.71 percent to 9.16 percent and then increased to 10.52 percent in the following year.

In the first half of the current FY 2014-15, the National Board of Revenue (NBR) has collected Tk. 59063.59 crore, which is 39.44 percent of the total target of Tk. 149720 crore for the whole fiscal year. In FY 2013-14 and FY 2012-13, the collection of total revenue, however, stood at 96 percent and 97 percent of the target respectively and therefore the gap was Tk. 25856 crore and Tk. 10847 crore respectively.

The UO, however, fears that this shortfall in revenue collection is likely to cause the budget deficit to rise to 7 percent of GDP in FY 2014-15, if the current expenditure limit is maintained, which is most unlikely because of the lower annual development expenditure, and thereby exerting immense adverse impact on country’s economic growth.

Pointing to the lag in collecting Value Added Tax (VAT), the UO finds a that the collection of VAT(local) has stood at Tk. 14683.7 crore (37.86 percent) during the first half of FY 2014-15 against the target of Tk. 38780.42 crore for the whole this year, indicating an underperformance at the end of the fiscal year.

Along the same vein, the collection of income tax, which has been envisaged in the budget as the largest source of revenue, may undergo a hefty deficit at the end of the fiscal year as well. The collection of income tax has stood at Tk. 18721 crore (33.09 percent) during the first half of FY 2014-15 against the target of Tk. 56580 crore for the whole fiscal year.

As regards the import duty, the collection reached Tk. 6965 crore (48.45 percent) during the first half of FY 2014-14 against the target of Tk. 14376.7 crore for the whole fiscal year. The collection of import duty may, however, fall during the second half of the current fiscal year due to increasing cancellation of letters of credit.

Meanwhile, the collection of non-NBR revenue has also slowed down. The collection of non-NBR tax has stood at Tk. 1407 crore (25.25 percent) during the period of June’14 – October’14 against the target of Tk. 5572 crore for the FY 2014-15. These lags in collecting taxes can be attributed to current political unrest-induced reduced business activities, adds the research organization.

During the period of July’14 – October’14, the collection of non-tax revenue decreased by 36.5 percent compared to the corresponding period of the FY2013-14. The collection of non-tax revenue has stood at Tk. 7279 crore during the period of June’14 – October’14 against the target of Tk. 27662 crore for the whole fiscal years, whereas the collection was Tk. 11464 crore during the same period of the previous fiscal year, finds the UO.

Pointing to the economy’s lagging behind other developing economies in collecting tax, the Unnayan Onneshan demonstrates that the tax-GDP ratio stood at 9.7 percent against the target of 11 percent in FY 2013-14, whereas the ratio stood at 13.9 percent and 12 percent in 2013 Nepal and Sri Lanka respectively.

Noticing the status of low ADP implementation, the think tank finds that during the first half of FY 2014-15, the implementation of ADP stands at Tk. 27305 crore that represents 32 percent of the total allocation for ADP in FY 2014-15. The research organisation, therefore, cautions that the total implementation of ADP may fall short of target at the end of the current fiscal year amidst the continued political unrest.

Against this backdrop of gaps in collecting revenue, the Unnayan Onneshan urges for an inclusive political dialogue amongst the political parties to reach solutions that would boost the business activities in the economy and thus foster the collection and mobilisation of revenue.