Al Amin :

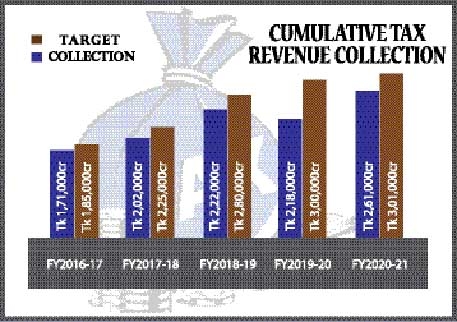

The National Board of Revenue (NBR) is facing a tough challenge in revenue collection in the current fiscal year as the government has decided not to revise the proposed target.

The proposed revenue collection target is Tk 3.3 trillion for the current fiscal year (2021-22).

The government has taken the decision after a long eight years. The Finance Ministry has already directed the NBR to take action in this regard.

Traditionally, NRB revised the revenue collection target every year. But the target will not be reduced this year, NBR officials said.

Businesses, however, said, the regular taxpayers will remain under additional pressure due to the decision and will also create scope of harassment by the taxmen for meeting the hefty amount of revenue target.

The country’s economy has started rebounding from the shock of the devastating Covid-19 pandemic. Many small and medium scale entrepreneurs are struggling to survive. Under this situation, the additional tax burden will hamper the business activities, they said.

Dr Ahsan H Mansur, Executive Director of Policy Research Institute (PRI), told The New Nation, “It is impossible to realise the ambitious target by the present structure of the NBR. The revenue board has no ability to reach the target.”

“The government is also apparently reluctant to bring expected reformation in the revenue board,” he said.

NBR officials said the Finance Ministry fixed an ambitious target every year and the NBR officials face difficulties to reach the big target. The officials are being bound to pressurize the businesses and then, tax payers raise allegation of harassment.

The NBR’s views should be taken into consideration in fixing targets for business-friendly revenue structures, they added.

The government took the similar decision in 2012-13, 2001-02 and 2002-03 fiscal years.

Abul Kasem Khan, former president of the Dhaka Chamber of Commerce and Industry (DCCI), said, “We saw ambitious revenue targets in the past, but that could not be achieved at the end of the year. From that point of view, it seems right to bring the revenue target closer to reality.”

“The tax policy is complicated, and it needs to be simplified. There are so many multiple rates in value-added tax, income tax, and import duty, so it is tough to apply them,” he said.

So, there are many chances for tax evasion, and the government is being deprived of getting tax, he said, stressing the need for completing tax automation to increase revenue.

“Automation of VAT and income tax has remained unimplemented for long. It is not that we are building a bridge that requires long time,” he said.