Abu Sazzad :

The National Board of Revenue (NBR) failed to collect revenue target in the first quarter (July to September) in the current fiscal 2015 -16 mainly due to inefficiency and inner conflict of the officials, said experts.

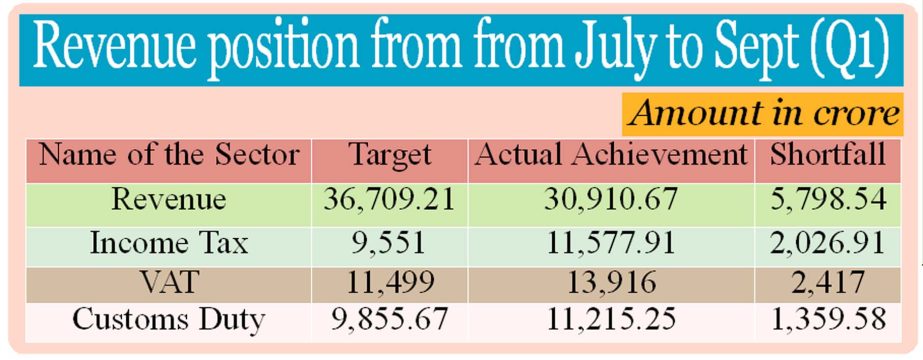

The NBR has set the revenue collection target of Tk 36,709.21 crore in the first quarter, but the actual achievement was Tk 30,910.67 crore. Revenue collection target were lack behind of Tk 5,798.54 crore or 15.81 per cent, according to provisional data of the NBR released recently.

The government has set the revenue collection target of Tk 2,08,443 crore in the national budget for the ongoing fiscal in which Tk 1,76,370 crore was fixed for NBR.

Actually, the revenue income generates from three major sections such as income tax, value-added tax and customs duty, but unfortunately the entire section have failed to meet the target set for the period.

A senior NBR official said on the condition of anonymity, the revenue collection experienced such a huge shortfall in the first quarter mainly because of dull economic activities both in domestic and external sectors. The domestic consumption, industrial production, trading activities, import-export performance was not good in the period.

VAT collection faced the highest shortfall with Tk 2,417 crore followed by income tax for Tk 2,026.91 crore and customs duty with the lowest deficit of Tk 1,359.58 crore.

Total VAT collected Tk 11,499 crore against the target of Tk 13,916 crore in this period. On the other hand, Income tax and customs duty earned Tk 9,551 crore and Tk 9,855.67 crore respectively against their respective target of Tk 11,577.91 crore and Tk 11,215.25 crore.

Officials said, the reason behind for falling revenue target are sluggish export growth, low rate of ADP implementation and extension of deadline on tax return submission.

Actually, the NBR official gave the statement to The New Nation to cover their inefficiency for collecting revenue during the period. The latest Bangladesh Bank data disclosed that overall import growth is satisfactory level of growth by 8 per cent and according to Export Promotion Bureau export grew by 0.83 per cent during this period.

The CPD’s Research Fellow Towfiqul Islam Khan said, lower commodity prices in the international market and failure to accelerate private investment have taken a pressure on revenue collection.

There is no doubt revenue collection target for the current fiscal year was ambitious.

It is critically important to enhance administrative efforts for revenue mobilization. But in this regard, NBR fails to reform its administration in recent years. Administrative reformation of NBR can enhance tax mobilization efforts”, he said.

The revenue shortfall needs to be checked in order to maintain fiscal balance, particularly in view of the recent pay scale revision for public servants, he opined. Lower revenue collection will put pressure the government, which can hinder the basic public services and overall development of country’s infrastructure.

“If such trend cannot be reverted, the government will need to consider an early revision of the national budget for the ongoing fiscal year in view of recent developments,” said Khan.

The NBR chairman Md Nojibur Rahman told The New Nation recently, NBR already has asked its field offices to take effective and pragmatic steps towards collecting outstanding taxes across the country.

The National Board of Revenue (NBR) failed to collect revenue target in the first quarter (July to September) in the current fiscal 2015 -16 mainly due to inefficiency and inner conflict of the officials, said experts.

The NBR has set the revenue collection target of Tk 36,709.21 crore in the first quarter, but the actual achievement was Tk 30,910.67 crore. Revenue collection target were lack behind of Tk 5,798.54 crore or 15.81 per cent, according to provisional data of the NBR released recently.

The government has set the revenue collection target of Tk 2,08,443 crore in the national budget for the ongoing fiscal in which Tk 1,76,370 crore was fixed for NBR.

Actually, the revenue income generates from three major sections such as income tax, value-added tax and customs duty, but unfortunately the entire section have failed to meet the target set for the period.

A senior NBR official said on the condition of anonymity, the revenue collection experienced such a huge shortfall in the first quarter mainly because of dull economic activities both in domestic and external sectors. The domestic consumption, industrial production, trading activities, import-export performance was not good in the period.

VAT collection faced the highest shortfall with Tk 2,417 crore followed by income tax for Tk 2,026.91 crore and customs duty with the lowest deficit of Tk 1,359.58 crore.

Total VAT collected Tk 11,499 crore against the target of Tk 13,916 crore in this period. On the other hand, Income tax and customs duty earned Tk 9,551 crore and Tk 9,855.67 crore respectively against their respective target of Tk 11,577.91 crore and Tk 11,215.25 crore.

Officials said, the reason behind for falling revenue target are sluggish export growth, low rate of ADP implementation and extension of deadline on tax return submission.

Actually, the NBR official gave the statement to The New Nation to cover their inefficiency for collecting revenue during the period. The latest Bangladesh Bank data disclosed that overall import growth is satisfactory level of growth by 8 per cent and according to Export Promotion Bureau export grew by 0.83 per cent during this period.

The CPD’s Research Fellow Towfiqul Islam Khan said, lower commodity prices in the international market and failure to accelerate private investment have taken a pressure on revenue collection.

There is no doubt revenue collection target for the current fiscal year was ambitious.

It is critically important to enhance administrative efforts for revenue mobilization. But in this regard, NBR fails to reform its administration in recent years. Administrative reformation of NBR can enhance tax mobilization efforts”, he said.

The revenue shortfall needs to be checked in order to maintain fiscal balance, particularly in view of the recent pay scale revision for public servants, he opined. Lower revenue collection will put pressure the government, which can hinder the basic public services and overall development of country’s infrastructure.

“If such trend cannot be reverted, the government will need to consider an early revision of the national budget for the ongoing fiscal year in view of recent developments,” said Khan.

The NBR chairman Md Nojibur Rahman told The New Nation recently, NBR already has asked its field offices to take effective and pragmatic steps towards collecting outstanding taxes across the country.