Special Correspondent :

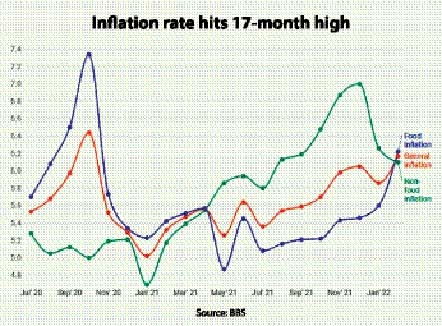

Inflation outstripped forecasts and surged above 6 per cent last month to hit its highest level in 17 months as spiralling food and commodity prices pushed up the cost of living.

Overall inflation rose to 6.17 per cent in February, higher than the 5.30 per cent that had been expected by the government and up from 5.86 per cent a month earlier, official figures from the Bangladesh Bureau of Statistics (BBS) showed.

The BBS yesterday released its February issue of the regular discloser titled “Consumer Price Index (CPI), Inflation Rate and Wage Rate Index (WRI) in Bangladesh” indicating a drastic price increase of food items.

In February, Bangladesh economy witnessed 6.22 per cent inflation on food items that was 5.6 per cent in January. This showed that the food inflation rate increased by 62 basis points in a month.

On the other hand, non-food inflation reduced by 16 basis points in the last month and stood at 6.1 per cent inflation in this segment was 6.26 per cent in January.

BBS collects price data from 140 (64 from urban, 64 from rural, and 12 from Dhaka City Corporation) main markets across the country.

Three price quotes per item are collected from each of the markets. Prices of 151 food items as well as 271 non-food items in urban areas, 133 food items as well as 185 non-food items in rural areas were also collected to compare inflation rate.

“Inflation touched a 17-month high because of soaring food and commodity prices,” said Dr Ahsan H Mansur, Executive Director of the Policy Research Institute (PRI).

He pointed out that prices of essential commodities such as rice, flour, edible oil, sugar and onions etc. are on the rise both at home and abroad. This has resulted in a higher rate of inflation.

Worried by rising inflation, Dr Zahid Hussain, former lead economist at the World Bank, said, “Higher prices for commodities pushed up inflation, and in turn eroding the value of incomes.”

“Not only in Bangladesh, prices for energy, grains and metals soared globally since Russia’s invasion of Ukraine. The conflict has disrupted trade and supply chain,” he said, adding, “Russia and Ukraine are major commodities producers, and disruptions have caused global prices to soar, especially for oil, natural gas and wheat. Both the countries make up 30 per cent of global wheat exports.”

He further said food and commodity prices continue to rise all-over the world and the entire global economy will feel the effect of faster inflation.

Dr Zahid Hussain mentioned that low- and middle-income people in Bangladesh struggle to cope with the soaring commodity prices. The pressure of price hike of essential item and inflation will further increase inequality in Bangladesh.

He, however, lauded the government’s initiative of selling essential commodities at subsidised rates among 1 crore poor people across the country through Trading Corporation of Bangladesh (TCB).

“This initiative will help ease pressure of low-income people amid soaring prices of daily essentials,” he added.

Dr Zahid Hussain also said that the government must focus on reaching essential commodities to the poor and low-income people.

The average inflation rate in 2021 stood at 5.54 per cent, down from 5.69 per cent in the previous year.

The government aims to keep the inflation rate within 5.30 per cent in the current fiscal year.