New Nation Report :

Bangladesh should focus on grid investment and renewables rather than transitioning from imported coal to imported LNG to reduce the need for major tariff hikes, according to a recent analysis from the Institute for Energy Economics and Financial Analysis (IEEFA).

The country is now preparing a new Integrated Energy and Power Master Plan (IEPMP) with funding from the Japan International Cooperation Agency (JICA).

The JICA-funded IEPMP assessment, according to energy analyst and report author Simon Nicholas, represents an opportunity for Bangladesh to suspend the construction of planned LNG and coal power plants and reset planning to provide a financially sustainable power system in the long run.

Due to rising costs of power generation and purchasing based on imported coal, liquefied natural gas (LNG), and oil, the BPDB recommended a bulk electricity tariff increase of up to 64 percent to the Bangladesh Energy Regulatory Commission (BERC) in January 2022. According to reports, if tariffs are not hiked as intended, the BPDB will face a Tk325 billion (US$3.8 billion) shortage.

Whatever the outcome of these suggestions, tariffs will not be raised much for the foreseeable future. Overcapacity, rising capacity payments – which are expected to rise to Tk132 billion (US$1.5 billion) in FY2020-21 – and a growing reliance on price-volatile imported fossil fuels are all eroding the BPDB’s financial position. On its current course, the BPDB’s operating losses are certain to escalate, forcing additional government subsidies and tariff increases.

The cost of energy obtained from IPPs now accounts for more than half of BPDB’s total operating expenses for the first time. The new coal-fired power plant in Payra was the single largest contributor to the IPP load. In FY2020-21, the cost of each unit of power purchased from the plant climbed by 36.5 percent to Tk8.6/kWh, up from Tk6.3/kWh the previous year. This was fueled by capacity payments paid to the plant as one of its units remains idle due to a delay in power transmission infrastructure building. The BPDB pays the Payra power station Tk1.3 billion (US$15 million) in capacity charges per month.

The cost of electricity purchased from independent power plants (IPPs) increased by 58 percent over the previous year, causing BPDB’s operating loss to double in FY2020-21. The necessary government subsidy to bail out BPDB’s losses hit a record Tk117.8 billion (US$1.4 billion) as a result of the bank’s high operating deficit, up from Tk74.4 billion the previous year. “The rising cost of power generation and procurement based on imported coal, liquefied natural gas (LNG), and oil is sinking BPDB,” Nicholas argues.

According to the BPDB’s annual report for FY2020-21, 12,967 megawatts (MW) of additional electricity capacity is under development, with a total of 19,651MW projected by the end of FY2024-25. According to the BPDB, just 3,990MW of old capacity will be retired over the same time span.

600MW of additional oil-fired power plants, the 2,400MW Rooppur nuclear project, the long-delayed Rampal coal plant, and the considerably over-budget and over-schedule Matarbari 1 coal plant are all on the horizon. According to the BPDB, Adani Power’s Godda coal power plant in Jharkhand, India, which will export power to Bangladesh, is scheduled to be completed in 2022.

In addition, major LNG-fired power generation is expected to come online by 2025, with much more planned after that, increasing Bangladesh’s vulnerability to the volatile LNG market. LNG prices climbed beyond US$50/MMBtu in 2021, setting new highs. Bangladesh was forced to pay record spot LNG prices as a result, exposing the danger of the country growing more dependant on foreign fuel. As a result, gas distributors have proposed to BERC a tariff increase of more than doubling.

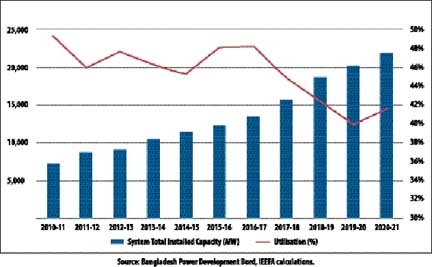

Overall power plant utilisation will drop further by FY2024-25 as a result of these big capacity expansions in excess of likely power generation growth. Even if electricity generation develops at a rapid rate of 12% per year through FY2024-25, global power capacity utilisation may fall to just 38%.

The impact of such poor utilisation of new power plants, especially IPPs, is that capacity payments to these plants will continue to rise while they sit idle for long periods of time, increasing the BPDB’s expenses and losses.

The BPDB’s record-high government subsidy in FY2020-21 cannot be considered a peak. With more capacity expected to come online, resulting in increased overcapacity and higher capacity payments, government subsidies will likely be necessary to cover BPDB’s escalating losses in the future. According to the BPDB, the government subsidy required in FY2021-22 might be Tk200 billion, up 71% from the record subsidy in FY2020-21.

The current overcapacity in the power system, rising capacity payments to under-utilized power plants – which are expected to rise to Tk132 billion (US$1.5 billion) in FY2020-21 – and the growing reliance on price-volatile imported fossil fuels are all eroding BPDB’s financial position.

In FY2020-21, this resulted in a 58 percent increase in Independent Power Producer (IPP) expenses. The cost of electricity purchases from IPPs accounted for more than half of the BPDB’s overall operating expenses for the first time.

“With additional IPPs set to come online – and more coal and LNG facilities planned,” Nicholas notes, “BPDB’s operating losses can be projected to rise in the future.”

Bangladesh has already paid a premium for being exposed to the uncertain global LNG market. In 2021, LNG prices rose to new highs, forcing Bangladesh to pay new highs for spot LNG. Analysts do not expect the market to stabilise anytime soon.

Building local low-cost clean energy capacity would help the Bangladesh Power Development Board (BPDB) better its deteriorating financial situation, which is exacerbated by the country’s capacity over-expansion dependent on imported fossil fuels.

Given the electrical system’s already low overall utilisation rate of 42%, JICA must prioritise grid investment and renewables in the new master plan to increase dependability and reduce the country’s future reliance on costly, imported fossil fuels.”

The Sustainable and Renewable Energy Development Authority’s (SREDA) and Mujib Climate Prosperity Plan’s increased renewable energy ambitions, according to Nicholas, must be reflected in the new energy and power master plan.