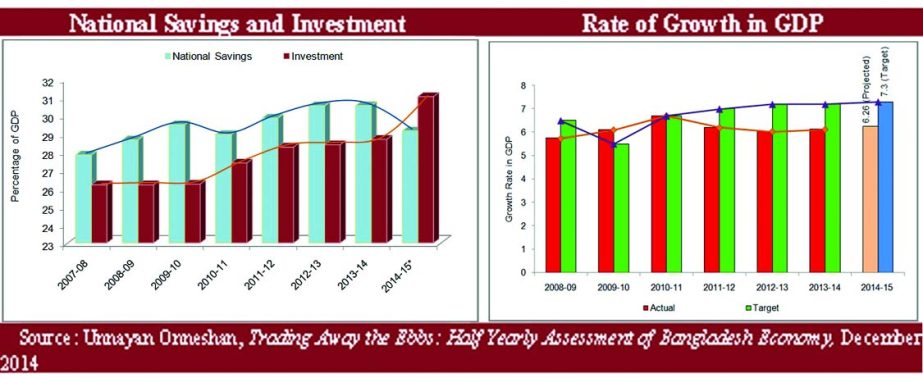

UNB, Dhaka :The rate of growth in gross domestic product (GDP) may fall short of the target due mainly to the economic factors – sluggish investment, infrastructural underdevelopments, unsatisfactory collection of revenue vis-à-vis target, low-performance in external sector, and non-economic factors – institutional weaknesses and current political uncertainties, Unnayan Onneshan (UO) in its half yearly assessment of the economy for FY 2014-15 reveals.The UO also suggests an urgent inclusive political dialogue that reducing the exigencies of current political uncertainly will ensure consolidation of democracy through regular transfer of power and cause the economy to grow faster.The independent multidisciplinary think tank after a rigorous assessment of the trends of major macroeconomic indicators during the first half of FY 2014-15 projects that if the business as usual situation continues the rate of growth in GDP falling short of the target of 7.3 percent may stand at 6.26 percent at the end of the current fiscal year.Taking account of the impact of non-economic factors such as political uncertainty together with underdeveloped infrastructure, the think tank opines that industrial production has been badly affected by the current uncertain political situation-induced risky investment climate.As regards declining private investment, the think tank shows that private investment as percentage of GDP has been on the decline since FY 2010-11. In FY 2011-12, private investment stood at 22.50 percent, which reached to 21.75 percent and 21.39 percent in FY 2012-13 and FY 2013-14 respectively.Referring to increased gap between savings and investment, the research organization evinces that in FY 2012-13 and FY 2013-14, the national savings were 30.53 percent and 30.54 percent, whereas the total investment were 28.39 percent and 28.69 percent of the GDP representing 2.14 and 1.85 percentage point gaps respectively.Pointing to the economy’s lagging behind other developing economies in collecting revenue, the UO demonstrates that the tax-GDP ratio stood at 9.7 percent against the target of 11 percent in FY 2013-14. Meanwhile, the ratio stood at 13.9 percent and 12 percent in Nepal and Sri Lanka respectively in 2013.The total number of the holders of Taxpayers Identification Number (TIN) is only 17 lakh which is only 1.09 percent of the total population against 69 lakh people of taxable income. Among the total number of TIN holders, only 8.55 lakh people that represent 0.54 percent of the total population submitted their tax returns in November 2014.Referring to the collection of tax revenue against the target of Tk. 149720 crore for FY 2014-15, the think tank states that in the first four months of the FY 2014-15, the total tax revenue collection stands at Tk. 38005.81 crore, which is 25.38 percent of the target. In FY 2013-14 and FY 2012-13, the collection of revenue, however, stood at 96 percent and 97 percent of the target respectively.Noticing a lack of sustainable increase in implementation of Annual Development Programme(ADP), the UO explicates that despite increasing allocation, ADP implementation has been falling short of target. In FY 2012-13, 96 percent of total ADP was spent vis-à-vis 94 percent in FY 2013-14. In FY 2014-15, allocation for ADP is Tk. 80315 crore, representing a 33.85-percent-point higher than the revised ADP of the FY 2013-14. ADP implementation until October 2014 reached Tk. 11250.82 crore or 13% of the total allocation.Pointing to financing deficit-induced increase in non-development expenditure and decrease in development expenditure, the UO illustrates that in FY 2012-13 and FY 2013-14, non-development budget stood at 12.1 percent and 13.2 percent of total GDP, whereas the allocation for ADP was only 4.7 percent and 5.1 percent respectively. In FY 2014-15, the allocation for the non-development expenditure and ADP, however, is 12.7 percent and 6.3 percent respectively.Taking account of recent low-performance in external sectors due to tensions in international relations with the certain export destination countries, the research organization demonstrates that in July-October period of FY 2014-15, the overall balance of payment decreases to USD 1246 million from USD1649 million of the corresponding period of FY 2013-14.Between July and September of FY 2014-15, trade deficit has increased by USD 1128 million more than that of the corresponding period of the previous fiscal year. Trade deficit in the first quarter of FY 2014-15 has, however, increased by 17.97 percent as export earning has decreased by USD 71 million compared to increase of USD 1199 million in import payment. Decrease in export can partly be attributed to the suspension of Bangladesh from enjoying the generalised system of preferences (GSP) in the US, says the think tank.Both flow of remittance and number of overseas employment are on the decline since 2012. In 2012, the flow of remittance and the total number of overseas employment stood at Tk. 115816.93 crore and 607798, whereas the amount and the number came down to Tk. 108066.93 crore and 409253 in 2013 and Tk. 106062.33 crore and 382298 until November in 2014 respectively, finds the UO.Referring to institutional weakness of the economy, the research organization says “country’s banking sector is caught in trap and is characterised by high interest spread, excess liquidity and declining growth in disbursement of credit to private sector coupled with poor risk management, fraudulence, captured governance and lax oversight.”In FY 2010-11, the rate of growth in quantum index of production (QIP) was 16.95 percent, which decreased to 10.79 in FY 2011-12 percent and slightly increased to 11.59 percent in FY 2012-13 percent. Later on, the index drastically fell and stood at 8.3 percent in FY 2013-14.The issue carries out the assessment against the backdrop of current economic management by the new government of which 154 members of the parliament won without any contest in the national parliament election of 2014. The election, therefore, is questioned because of its quality of not being participatory as the major opposition party did not participate in it.The research organization has called for an expedient seven-point policy measures – improved international diplomacy, employment enhancement strategies, higher revenue collection through expanding tax base, institutional reform in financial sector, increased private investment through incentivizing investors, narrowing interest rate spread through effective harmonisation of macroeconomic policies, and development of a functional social security system.