Bangladesh has made rapid progress in human resource development compared to many of her neighbours. In 2009, while the value of our Human Development Index (HDI) was 0.535 it is now 0.579 according to Human Development Report (HDR) 2016 published in 2017. Moreover, Bangladesh is now categorised as a ‘Medium Human Development’ country. In fact, the stunning progress in this area is attributed to the human development friendly policy-strategy along with channelling of huge resources for relevant sectors that include education, health and skill enhancement.

Education

With the agenda in mind for promotion of universal and quality education, we formulated our ‘National Education Policy 2010’ and embarked upon its implementation. We are relentlessly working with the aim to provide quality education for all through various programmes such as distribution of free textbooks and logistics among primary and secondary students; providing stipends for students studying at primary to degree and/or equivalent levels; implementing school feeding programmes in poverty-pockets; construction and maintenance of educational infrastructures; ensuring supportive environment together with provision of pure drinking water in educational institutions; printing primary level books in different languages; operating pre-primary schools; valuing creative talents; establishing Prime Minister’s Education Assistance Fund; setting up educational institutions in public sector and nationalisation of private educational institutions; recruitment of required number of teachers for reducing student-teacher ratio and providing training to teachers and encouraging innovation and use/penetration of information technology.

Health and Nutrition

As part of this overarching agenda, we have made operational 13,500 community clinics by recruiting 13,842 health care providers to reach the health services to the doorsteps of the rural poor and the marginalised community. Programme for providing vouchers for poor-destitute pregnant mothers is being implemented in 53 upazilas. ‘Health Protection Programme’ has been introduced for people living below poverty line. Under this programme, 68,000 families have been registered in three upazilas, who are receiving OPD and IPD services by using cards. Free consultancy services from physicians are now available 24 hours via ‘Health Window’.

Power and Energy

Power and energy are the main priority sector of our government. Back in January 2009 when we took office, power generation capacity of the country was 4,942 MW. Against this backdrop, we prepared the ‘Power Sector Master Plan’ with a coordinated development strategy for power generation, transmission and distribution and implemented various activities following this plan. Our target was to scale up power generation to 24,000 MW by 2021 and ensure electricity supply to all in affordable price.

The number of power plants rose to 118 from 27, power generation capacity has now increased by three times to 18,353 MW due to our persistent efforts. Maximum power generation record reached 10,958 MW from 3,268 MW in 2009. During last nine years, construction of 2,622 circuit km transmission line, 174,000 km distribution line has been completed. Length of present transmission and distribution line are 10,680 circuit km and 450,000 km respectively. System loss of power has reduced to 11 per cent from 16.9 per cent during this period. Overall, the percentage of population under electricity coverage has increased to 90 per cent from 47 per cent.

Development of Communication Infrastructures and Ports

In communications sector, we laid emphasis on the development of integrated mode of transport combining road, rail and waterways. Easing traffic congestion and safe mode transport is another area where we put our emphasis as well. Under various projects from FY2008-09 to FY2016-17, 465 KM roads were converted to 4-lane highways including Dhaka-Chattogram national highway, Dhaka-Mymenshing national highway, Nabinagar-DEPZ-Chandra highway, Jatrabari-Kachpur highway; 3,931 km highways have been strengthened and 4,592 km highways have been widened; bridges and 3,546 culverts were constructed/ reconstructed.

Economic Zones and Mega Projects

One of the pre-conditions for rapid economic development is increased investment. We are gradually increasing public investment. However, the purpose of this investment is to create investment-supporting environment for the private sector. Availability of electricity, gas and water connections, timely processing of investment proposals, availability of undisputed land etc. play crucial role in attracting private investment. By making these services easily available to the investors, we enacted ‘Bangladesh Economic Zones Act’ in 2010 for establishing economic zones in potential areas to expand/develop export oriented industries and attract foreign investment. In pursuant to this Act, Bangladesh Economic Zone Authority (BEZA) was established under Prime Minister’s Office in 2011. Besides, the ‘Private Economic Zone Policy 2015’ was formulated. Project clearance, visa recommendation and assistance, work permit, import/export permits services are now being processed under one stop service from BEZA. Our mission is to establish 100 economic zones in 30,000 hectares of land by 2030.

Establishment of 76 economic zones has been approved so far/till now and the Hon’ble Prime Minister herself has inaugurated 10 of them. Foreign and local investors have started setting up industries in these zones.

Social Protection Programme

Total allocation for social security was only Tk.373.2 crore in FY2005-06. This allocation has been raised to Tk.64,656 crore in FY2018-19, which is 2.55 per cent of GDP and 13.92 per cent of total budget. Only 13 per cent families enjoyed social protection benefits in 2005; this has been raised to 28.7 per cent in 2016.

Structural Transformation of the Economy

In FY2005-06, the contributions of agriculture, industry and services sectors to GDP were 19.0, 25.0 and 55.6 per cent whereas according to provisional estimate of FY2017-18, these contributions will be 14.10, 33.71 and 52.18 per cent respectively.

Internal economic situation

We set the target for this year’s GDP growth at 7.4 per cent. Meanwhile, Bangladesh Bureau of Statistics has estimated the growth rate at 7.65 per cent. Overall, in the current fiscal year, the target of food grains production has been set at 4.07 crore metric tonnes.

Science and Technology

We are encouraging science and technology related research activities to build a science-savvy nation. We have widened the coverage of the ongoing science quiz contest and extended it from district to upazila level aiming to kindle student’s interest in science education. I, therefore, propose to allocate Tk. 12,200 crore in the budget for next fiscal year for the Ministry of Science and Technology.

Water Resources

Flood-Draught-River Erosion Control and Land Reclamation: In order to augment navigability of our rivers, reduce erosion and ensure water flows in dry season, we will carry out 470 km river dredging, excavate 530 km irrigation canals, construct/repair 860 irrigation structures, construct of 3 barrages and rubber dams, construct/repair 240km flood control and coastal embankments, 710 flood control and drainage infrastructures, and excavate/re-excavate 1,525 drainage canals by 2021. Besides, there is a plan to reclaim 110 acres of land from sea by building 6 cross dams.

Public Welfare

Food Security: Our goal is to ensure adequate supply of safe and nutritious food and maintain adequate stock of food grain during emergency. At present the food grains storage capacity is 21.2 lakh metric tonnes at government level. In order to raise this capacity to 270 lakh metric tonnes, construction of additional modern food go-downs/silos having the capacity of 6.4 lakh metric tonnes is underway by 2020.

‘Food and Nutrition Security Policy 2018-19’ is being formulated as a priority of the Hon’ble Prime Minister as well as for the implementation of SDGs. We are implementing nutrition development programme for mothers, children and adolescents in Sylhet and Moulvibazar region on a pilot basis. Once it is successful it will be rolled out across the country.

Industry and Trade

Small and Medium Enterprises (SMEs): Our efforts are continuing to reduce of fertilizer, sugar and paper through state-owned industrial enterprises, motorized vehicle assembling, development of small and medium cottage industry, ensuring quality of the production and preservation of intellectual property have been some of our continuous efforts. Moreover, industrial park and industrial city establishment in different districts and BSCIC areas, building buffer warehouses for fertilizer preservation and distribution facilities, establishing ship breaking industry and building shipyards; reopening the closed industries; and establishing recycling industries, among others, are being initiated.

Tourism Industry

To promote tourism, we have taken necessary steps to establish marine aquarium at Cox’s Bazar, tourist spot of international standard at Cumilla along the Dhaka-Chittagong highways, tourist spots at Khaliajuri and Birishiri of Netrokona, watchtowers at Tekerghat and Kuakata together with modern rest houses in different district headquarters. We are implementing community-based and backwater tourism to involve the local community with the tourism industry. We are proud to share our sense of fulfilment that Bangladesh has been elected as the chairperson of Islamic Conference of Tourism Ministers (ICTM) for a term of 2018- and Dhaka has been announced as the OIC City of Tourism for 2019. This will encourage our tourism industry to be engaged in harnessing its potentials.

Rejuvenated Jute Industry

We have taken steps to strengthen programme for producing composite jute textiles, soft-drinks from jute leaves, geo-textile bags suitable for protecting river banks, shopping bags along with multi-purpose jute products and their marketing. In addition, steps have been taken to produce and export charcoal made from jute stick, a jute by-product. Centralized management of public sector jute industry is not suitable for the growth of this sector. To get rid of the situation we must adopt Public Private Partnership (PPP) concept to run the jute mills.

Textile Industries: A number of textile engineering colleges, textile institutes and textile vocational institutes are being set up in different districts of the country to produce skilled manpower for textile and readymade garments sector. Besides, fashion design training institutes and training sub-centres are also being strengthened.

Trade Expansion: We are continuing our efforts to expand our trade to raise the export earnings from US$50 billion to US$60 billion by 2021. Simultaneously, we are redesigning our trade strategy considering the post-graduation reality as the country has recently met the relevant criteria for LDC graduation.

We will create our competitive edge by diversifying export goods, expanding existing markets and exploring new ones, and taking diplomatic initiatives to facilitate Free Trade Agreement (FTA) and extension of duty-free trade regime. We are now evaluating the feasibility of signing free and preferential trade agreements with Malaysia, Myanmar, Sri Lanka, China and Turkey. We have already signed agreement with 44 countries to remove tariff and non-tariff barriers. Entering into bilateral agreements with some other countries is under way. On the other hand, efforts to expand trade under regional and multilateral agreements like SAPTA, SAFTA. APTA, BIMSTEC are also continuing.

Climate Change and Environment

Climate Change: In the light of Bangladesh Climate Change Strategy and Action Plan (BCCSAP), 44 activities under 6 thematic areas are being implemented for mitigating and adaptation of the effects of climate change. These activities have been brought under government budget classification to capture total expenditure on climate change. Besides, various programmes are being implemented under ‘Bangladesh Climate Change Trust Fund’ created with own fund. Bangladesh as a member of United Nations Framework Convention on

Climate Change (UNFCCC) has submitted Intended Nationally Determined Contributions (INDC) in which intentions for reducing carbon emission by 5 per cent with own initiative and 15 per cent with international cooperation by 2030.

Environmental Pollution: Quality of air is being monitored through fulltime Air Quality Monitoring Station. Inter-state air quality is also being monitored through Air Quality Monitoring Station stationed in Satkhira. For controlling industrial wastes, construction of waste refinery, recycling of liquid waste, adopting zero discharge plants, and establishment of Environmental Treatment Plants in factories, among others, are being conducted. Steps are being taken to conserve/protect most polluted rivers the Buriganga, Balu, Turag and Halda and coastal areas by declaring them as environmentally endangered areas. In addition, various activities including sustained management of marine resources, reducing use of CFCs to 35 per cent and conserving environment and biodiversity have been taken.

Conservation and Expansion of Forest: We are conserving and expanding forest land by adopting sustainable forest management strategies including raising seedlings, creating block-strip forests, afforestation of coastal shoals, and social forestry, among others. we have plan to create green belt by creating mangrove forests in 28,526 hectares of land covering 512 km coastal area by 2021. In addition, steps are being taken to measure carbon level in 15 protected areas including the Sundarbans. Updated information are being collected on forest resources and preparing forest cover maps using satellite imaging for ICT based forest management. Also, determination of boundary of forests and identification of land by using records and maps has begun.

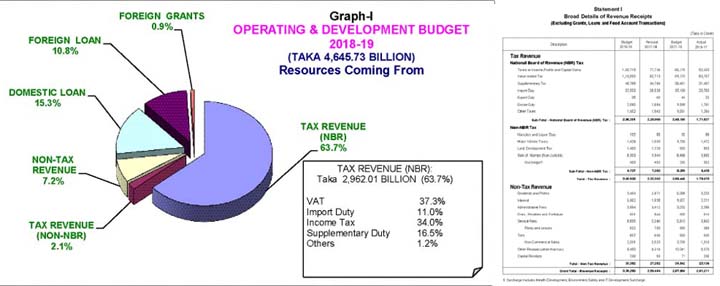

Revenue Collection Activities

National Board of Revenue (NBR) collects almost 85 percentages of our total revenue. The impetus of revenue collection has been quite good in recent years. Average growth of NBR revenue collection in this decade is more than 17 percentages, which is the highest in last 4 decades. As a result, our tax-GDP ratio is increasing gradually although not to our satisfactory level. NBR mainly collects revenue from four sources such as, income tax, import and export duty, VAT and supplementary duty. Revenue target of NBR according to this year’s revised budget and proposed budget for next fiscal year is shown below. Excise Duty and Turnover Tax are mainly parts of VAT.

It is essential to collect adequate revenue from internal sources to continue current economic progress. We have emphasized on collection of revenue not by increasing tax rate but through expansion of tax base and encouraging self-compliance by reforming existing tax system. In case of Income Tax, area of tax related services has been expanded. Income Tax Fairs are being arranged throughout the country, where taxpayers are participating with great enthusiasm. This year almost 2 lakhs taxpayers have submitted Income Tax Return in tax fairs; almost 9 lakhs taxpayers have received tax related services. Initiatives have been taken to make the tax management system fully automated and digitalized by increasing use of ICT in tax administration. e-TIN registration is working very smoothly; on-line return submission system has been introduced, plan of enhancement of which is also being taken. We hope that a considerable number of taxpayers is going to submit their returns on-line in upcoming years. Tax collection is no more considered as harassment. Tax base is quite extensive now. The number of registered tax payers and return submission has increased beyond our expected level. Number of registered tax payers is more than 35 lakhs now. I hope number of registered taxpayers and return submission within next 5 years would be one crore and eighty lakhs, respectively. People’s trust in income tax system, especially spontaneous participation of young generation in tax payment is giving us a very positive signal.

Now I am presenting the proposal regarding our plan for revenue collection from taxes and duties in FY 2018-2019. Proposals for revenue collection from all four sources such as, Direct tax, Value Added Tax (VAT), Supplementary duty and Import-export duty are presented one after another.

There is always much discussion on what should be the ideal tax exemption threshold. In developed countries, tax exemption threshold is generally less than 25 percent of per capita GDP, and in developing countries it is mostly equal to per capita GDP. In Bangladesh, tax exemption threshold is almost 200 percent of per capita GDP. That means our tax exemption threshold is high in global comparison. Moreover, the increase of tax exemption threshold puts a significant number of taxpayers out of the tax net. Considering all these, I propose that the tax exemption threshold and tax rate remain unchanged for the next year except that the thresold for a parent or guardian of a person with disability will be higher by Taka 50 thousand for each of such child or dependent. Tax rates for non-company taxpayers have been proposed in the table below:

Corporate Tax Rate

It is often argued that the corporate tax rate in Bangladesh is high. This is not correct. Corporate tax for publicly traded company in Bangladesh is 25 percent, which is lower than many countries in South Asia and very compatible with global average (24.29 percent). However, tax rates for banks and financial institutions are a bit higher than other corporate sector. Therefore, I propose to reduce the tax rate for banks and financial institutions by 2.5 percent. We will lose a certain amount of tax revenue from such rationalization of corporate tax rate; however, this will give a positive signal to our investors. I also propose that corporate tax rates for other companies remain unchanged. With this proposed rate, our highest corporate tax rate will be mostly percent, and next highest rate will be 37.5 percent, except for tobacco manufacturers and non-listed mobile phone operators. The proposed tax rate for company taxpayers has been presented in Table -:

Equity and Fairness

Surcharge: I propose a minimum surcharge amounting to Taka 3000, where net wealth of an individual exceeds Taka 2 crore and 25 lakh and a minimum surcharge amounting to Taka 5 thousand for individuals who have a net wealth exceeding Taka 10 crore. In addition, 2.5 percent surcharge on the manufacturers of cigarette, bidi, zarda, gul and other tobacco products will remain unchanged.

Facilitating Business and Growth

Readymade Garments: Readymade garments industry is playing an important role in generating employment and fostering economic growth. Taking into consideration of that fact, readymade garments sector has been given special tax incentives. In continuation to that policy, I am proposing to reduce the tax rate of manufacturer and exporter of readymade garments to 15 percent. If any such taxpayer is a public limited company, then tax rate will be 12.5 percent. Any garment factory having green building certification shall enjoy tax rate of 12 percent.

Reforms of Tax Management

We need extensive reforms in tax administration as well in order to successfully implement the reformed tax laws and regulations. In last year’s budget speech, I proposed introduction of the e-TDS system, establishment of a modern tax information unit, formation of appropriate administrative structure for international tax and the setting up of tax zones in important districts and tax offices in all upazillas. National Board of Revenue has done some works on those reforms.

I like to mention here that the last administrative reform of tax department took place during our government in 2011. In last few years after 2011, the number of taxpayers has tripled and the number of return filers has increased from 9 lakh to almost 16 lakh. Observing this positive trend in tax compliance, I am setting the target to increase the number of registered taxpayers to 1 crore and number of return filers to 80 lakh within next 5 years (by the end of FY 2022-23).

Value Added Tax (VAT)

Value Added Tax (VAT) is the single largest source of Government tax revenue collected by the National Board of Revenue (NBR). Highest revenue collection target is also set to be realized from VAT in 2018-19 Fiscal Year. Currently 9 truncated VAT rates are applicable. We are bringing down this to 5 rates this year; these are 2, 4.5, 5, 7 and percent. I am placing the following proposals before this august parliament related to VAT in order to collect desired revenue by increasing the Tax-GDP ratio while protecting the legitimate interest of our businessmen and consumers.

Online Return Submission

In order to facilitate online return submission, necessary changes already been made in the Value Added Tax Rule’1991. The online return submission process will be piloted in the Large Taxpayers Unit (VAT). Likewise, online tax payment system shall also be introduced this year. Online tax return facility shall be made available to all taxpayers after proper refinement of online return submission system. In addition, the traditional manual system of filing return shall also be continued for the taxpayers not having access to online facilities.

Introduction of Electronic Fiscal Device

Use of Electronic Fiscal Device (EFD) instead of Electronic Cash Register (ECR) and Point of Sale (POS) shall be made mandatory in all hotels, restaurants, resorts and shops across the country. This will enable the National Board of Revenue to have real-time access to business transactions which will eventually protect revenue leakage and increase revenue collection significantly.

Cigarette, Bidi and Smokeless Tobacco

Cigarette:

Bangladesh is a signatory to WHO Framework Convention on Tobacco Control (FCTC). Maintaining harmony with the anti-smoking state policies of the states around the world, decreasing use of tobacco, reducing health risk and increasing revenue collection are the big challenges of this sector. To face this challenge, NBR reduces price levels for shifting to a uniform tax rate irrespective of prices and we are gradually moving to this goal. Therefore, I am proposing to fix the price of the low segment for every 10 sticks of cigarette at Tk. 32 and above while increasing the supplementary duty rate to 55 percent. I am also proposing to increase the price of the medium segment for every 10 sticks of cigarette at Tk. 48 and increase the supplementary duty rate to 65 percent. At the same time, I am proposing to increase the price of the high segment for every 10 sticks of cigarette at Tk. 75 and Tk. 101 and keep the supplementary duty rate to existing 65 percent. Our goal is to gradually fix the price and supplementary duty rate in two slabs.

Bidi is more harmful than cigarette. Due to the overall improvement of socio economic status, bidi smokers are gradually declining. At present, number of workers presently working in the bidi industry is also less compared to previous years. Last year, we decided to abolish bidi production within 2/3 years. However, price of 20 sticks of filter bidi will be fixed at 15 taka from existing 12 taka.

Smokelesss tobacco like Zarda and Gul are another two health-hazardous items like cigarette and bidi. The detrimental impacts on health from consuming these items are even greater since these items are directly consumed. In order to reduce the consumption of smokeless tobacco products, I am recommending fixing the price of Zarda and Gul based on its weight. Here, I am proposing to fix price of 10 grams of Zarda and Gul at Taka 25 for next year.

VAT Exemptions

In order to protect legitimate interest of the agriculture sector, heavy engineering industry, textile and export sectors and also for the development and protection of some domestic industries, I am placing before the august parliament the following VAT exemption proposals either to be included or to be extended in this year’s budget-

Import and manufacturing Stage

Giving importance to the health safety issues of our citizens, I am proposing to exempt VAT on import or Erythropoietin, a very important medicine required for the treatment of Cancer and Kidney diseases.

Poor and low income group, particularly the laborers eat cheap loaf, bread, buns, handmade biscuits and handmade cakes up to Taka 100 per Kg. Considering this, I am proposing to exempt VAT on these items which are priced below 100 taka per Kg. I am also proposing to exempt VAT on hand made cakes except party cake which are priced below 150 taka per kg.

Mobile phone has a very important role to play in spreading information technology enabled services. In order to flourish mobile manufacturing industry and to attract investment in this sector, I am proposing to issue a separate SRO allowing the VAT exemption facility on mobile telephone set manufacturing. In addition, I am proposing to exempt surcharge on mobile manufacturing and to impose 2 percent surcharge on the import of mobile handsets.

I would also like to propose to exempt VAT for the local motorcycle manufacturers in order to substitute import of foreign motorcycles, attract more investments in this sector and boost export of motorcycles.

Service Stage

In accordance with Chicago Convention and worldwide practices of civil aviation authorities, I am proposing to exempt VAT on the port services rendered by the civil aviation authority for operating international flights only.

15 percent VAT is applicable against collection of insurance premium by the insurance companies. An insurance agent is appointed to provide service to the insured for which he gets certain commission. This commission is actually paid from the total premium collected by the agent. Hence, imposition of VAT against the commission of the insurance agent would result in double taxation. To avoid this, I am proposing to exempt VAT on insurance agent commission.

Imposition and increase of supplementary duty

Supplementary duty is imposed to protect domestic industries from facing international competition. In addition, this duty is also imposed with a view to restrict the use of certain undesirable or luxurious items. For achieving these two goals and also to collect more revenue, I am placing following proposals before this august parliament:

In order to reduce health risks through restricting the consumption of energy drinks, I am proposing to increase the supplementary duty on energy drinks to 35 percent instead of existing 25 percent.

Currently 10 percent supplementary duty is applicable on most of the cosmetics and beauty product items like lipstick, nail polish, body lotion etc. In order to establish an equitable and level playing field across the traders, I am proposing to impose 10 percent Supplementary Duty on all the similar products.

I am also proposing to increase the supplementary duty on toiletries, perfumes (except attar), body sprays and similar items (except aromatic vapour) from 10 percent to 15 percent.

I would like to propose to increase supplementary duty of cigarette and bidi paper from existing 20 percent to 25 percent.

I am proposing to increase the supplementary duty of bathtubs, zacuji and shower trays from existing 20 percent to 30 percent.

In order to reduce the use of energy inefficient filament lamps I am proposing to impose 10 percent supplementary duty on filament lamps.

In order to encourage the use of jute bags and to protect our environment I would like to propose to impose 5 percent supplementary duty on production of all kinds of polythene and plastic bags.

Truncated Base Price

Earlier, 22 services used to be taxed on the basis of truncated value. In order to establish a standard VAT system we need to gradually move out of this truncated value system. As part of this continuous process, I am proposing following measures to bring down current 9 rates to 5 rates:

At present 1.5 percent VAT is applicable on the sale of flats of sizes up to 1100 Square feet, 2.5 percent VAT is applicable on the sale of flats of sizes up to 1101-1600 Square feet and 4.5 percent VAT is applicable on the sale of flats which are above 1600 square feet. In order to incentivize the real estate sector I am proposing to fix 2 percent VAT on the sale of flats of any size which is less than 1600 square feet and keep the existing rate unchanged applicable for the sale of any flats bigger than 1600 square feet. Moreover, I am proposing 2 percent VAT on the resale of any flats irrespective of the size.

I am proposing 5 percent VAT rate on selling of furniture instead of existing 4 percent and 7 percent VAT on manufacturing of furniture instead of 6 percent.

I am proposing to 5 percent VAT rate on Transport Contractor of petroleum products, buyer of auctioned goods and branded garment outlets instead of 4 percent. Besides, 5 percent VAT shall also be applicable on sale of non-branded garment items in the local market.

I am proposing 5 percent VAT on information technology enabled services instead of 4.50 percent.

I am also proposing 5 percent Advance Trade VAT (ATV) at both import and trading stages instead of existing 4 percent.

With the fast development of internet technology, social media and mobile application platform based virtual business are booming. In order to bring these online based virtual businesses within the tax net a new service code has been defined as “Virtual Business” on which 5 percent VAT shall be imposed.

Tariff Value Issues

Considering prevailing market price and growth of the overall economy, I am proposing to rationalize the existing tariff values on some of the products like tomato paste, ketchups, sauce, different fruit pulps, fruit juices, lubricating oil, different kinds of paper and paper products, cotton yarn waste, waste denim, scrap/ ship scrap, CR coil, GP sheet, CI sheet, coloured CI sheet, frames and sunglasses etc. without imposing any extra price burden on the consumers.

Import and Export Duty

With your kind permission now I am placing the proposals on export and import duties before this august parliament. Considering the protection of local industries under the present global scenario, to generate more employment through investment in the industrial sector, improve public health, mobilization of resource etc. and a meticulous scrutiny of more than 1500 suggestions received from different stakeholders, we have prepared proposals for import and export duties for the 2018-2019 financial year budget. The key features of my proposals are to keep the price of the essential goods unchanged, to provide necessary protection to the domestic industries, to expedite expansion of export markets, and to rationalize tariff structure by reducing prevailing discrepancies. Keeping this view in mind, I propose that the existing slabs of Customs Duty (0%, 1%, 5%, 10%, 15%, and 25%) on import stage will remain same in 2018-19 fiscal year. Sometimes we make use of Regulatory Duty (3%) and Supplementary Duty to increase our revenue. However, our aim is to decrease the use of such duties.

Based on these basic principles I mentioned above, with your kind permission, I would like to present sector-wise elaborated proposals in this august Parliament:

Iron and Steel: In recent years raw materials import for iron and still industries has been decreased. Consequently, the revenue from this sector has been decreased drastically. Recently, there was a price hike of MS Rod in local market. To keep both the production cost and market price of MS Rod low, I propose reduction of Regulatory Duty on import of raw materials i.e. Ferro Alloy from 15% to 10%; and reduction of specific customs duty on import of Sponge Iron from Tk.1000/MT to Tk. 800/MT.

Milk Powder Processing: Filled Milk Powder (FMP) can give the similar nutrients to those who cannot afford whole milk powder. Considering the fact, countries like Malaysia, Indonesia etc. has allowed incentives on importation of FMP. To make milk powder affordable to the poor, I propose to decrease import duty rates of this item to 10% when imported in bulk quantities.

Refrigerator and compressor: In the last decade refrigerator industry got tremendous improvement through getting support from the government. Very recently, a compressor industry has also been established in Bangladesh with an advanced technology. Now, many high standard refrigerators and compressors are produced domestically. To facilitate local industries, I propose for reduction of customs duties on refrigerant, printed still sheet (0.3mm), copper tube, capacitor, connector, terminal & electrical apparatus to 5 percent and customs duties on wielding wire, spring and gasket to 15 percent.

Printing: To facilitate local printing industries, I propose to reduce import duties of their raw material like flexo and gravure in liquid form to 10 percent. On the other hand, increase in supplementary duties on printed leaflet, brochure, printed postcard, printed card, calendar etc. to 25 percent on import and 20 percent supplementary duty have been proposed.

Re-melted Lead: The main raw material of lead acid battery is lead which is collected from old lead acid battery. Some local battery manufacturers are recycling this lead in an approved environment friendly process and using them in their battery production. While other firms are recycling it through unapproved way and exporting it to neighboring countries. This unapproved way of recycling and exporting lead is damaging the environment of the country. There is no justification of lead export when we are importing them with higher price. In this respect, I propose an imposition of 25 percent Export Duty on re-melted lead export from Bangladesh.

Electrical goods: For the protection of local electronic industries, I propose to increase import duties of finished mobile battery charger, UPS/IPS, voltage stabilizer to 15 percent; to increase customs duty of automatic circuit barkers to 10 percent; and to increase supplementary duty of lamp holders to 20 percent. At the same time, I propose a reduction of import duties on raw materials of electrical goods i.e. carbon rod and formed core at different rates.

Transport sector

Hybrid Motor Cars: Considering energy efficient and environment friendly means of transport, we are providing duty benefit to hybrid vehicle from long ago. In the same way, in this budget, I propose reduction of Supplementary Duty (SD) on importation of 1600-1800 cc hybrid motor cars from 45 percent to 20 percent. This rate of duties will also applicable for the electric motor car.

Reconditioned Vehicle: In 2017-18 budget, yearly depreciation benefits for reconditioned cars have been restructured. I propose further 5% reduction of current yearly depreciation benefits in 2018-19 budget.

The government has been losing revenue from the importation of new car due to discrimination of tax rate (regulatory duty and supplementary duty) on CKD and CBU .This will be rationalized during the budget discussion. Considering high demand of double cabin pick up, I propose to reduce regulatory duty from 25 percent to 10 percent.

Motorcycle: Motorcycle manufacturing and assembling is a rapidly growing industry in Bangladesh. Four manufacturers have already in operation for last couple of years. Production of motorcycle is also increasing in every single year. In the last budget, an SRO allowing concessionary duties on raw material import was issued to facilitate the industry. I propose to continue this concessionary duty benefits for motorcycle producers including some inclusions, exclusions and changes of parts & raw materials in the SRO.

Leaf Spring: Leaf Spring is a widely used item in the vehicles of transport sector. This item is imported abundantly and also produced locally. To rationalize protection, keeping market price stable, and facilitate transport sector reduction of supplementary duty to 10 percent has been proposed in this budget.

Tyre and Tube: Paraffin wax and phenolic resins are raw material in the production of tyre and tube. To facilitate tyre & tube industry, I propose to reduce customs duty of paraffin wax to 10 percent and customs duty of phenolic resin to 5 percent.

Bicycle: To protect domestic producers of bicycle parts, I propose to increase Customs Duties of bicycle parts i.e. brakes and saddle to 25 percent.