Special Correspondent :

Bangladesh’s pharmaceutical industry boosted significantly increasing drug exports when the world was suffering from the coronavirus pandemic.

Pharma exports from Bangladesh witnessed over 20 per cent growth to US$105.5 million during the first six months (July– December) of the current financial year (2021-22).

Bangladesh exported life-saving medicines worth $86.3 million during the July-December period of last financial year (2020-21), according to the statistics of Export Promotion Bureau (EPB).

Local pharma industries basically used to export the medicines related to malaria, tuberculosis, cancer, leprosy, anti-hepatic, penicillin, streptomycin, kidney dialysis, homeopathic, biochemical, Ayurvedic and Hydrocele.Besides, coronavirus related drugs have also been added to the list in the last financial year.

At present, 60 local companies have been exporting high-quality medicines after fulfilling the local demand, according to industry insiders.

They said, there is a huge demand for life saving medicines produced in Bangladesh in different developed countries in the world including the US and Europe.

“Bangladesh’s drug exports have been growing consistently over the years owing to increased demand from overseas markets. The demand has also increased one more step globally in the ongoing coronavirus pandemic,” SM Safiuzzaman, Secretary General of the BangladeshAssociationof Pharmaceutical Industries(BAPI)told The New Nation yesterday.

He said, “The current trend of export growth is encouraging and if the trend persists the export value would be doubled by next June”.

Safiuzzaman added, “We are expecting big growth in our medicine exports in the coming months, as the Covid-19 pandemic increased demands for locally produced generic drugs Remdesivir and Favipiravir.”

He also said that the Middle East, Africa and Latin America are importing Remdesivir and Favipiravir from Bangladesh after India banned the export of these drugs and their ingredients last April due to massive spread of coronavirus in the country. “It has created a big opportunity for local drug manufacturers.”

Apart from other generic drugs,

about 20 local companies including Beximco, SKF, Incepta, Beacon, Square, Popular, Opsonin, ACI, Renata and Ziska Pharmaceuticals are now exporting antiviral drugs Remdesivir and Favipiravir used in the treatment of corona patients.

Safiuzzaman mentioned that various foreign companies have joined hands with some Bangladeshi companies as the local pharma industry has already gained global reputation through dynamism, technology and high quality drug production.

Responding to a question, he said they are penetrating potential export markets with the support of the ministry of commerce and Bangladesh missions to enhance the export earnings from pharma sector.

“I hope the pharmaceutical industry will be at the top of exports in the future,” he added.

The pharmaceutical industry in Bangladesh is one of the most developed technology sectors within the country.It is moving forward with great potential as 98 per cent of the country’s total demand for medicine is being met by domestic companies.

In addition to meeting the domestic demand, the leading companies are also exporting medicines to 151countries around the world. In view of its export potential, pharma has been declared as the thrust sector by the government of Bangladesh with an aim to diversify country’s export portfolio.

Tapan Chowdhury, Managing Director (MD) of Square Pharmaceuticals Limited said, “Drug exports from Bangladesh continue to grow as the local pharma industry has been producing and supplying international standards medicines with adoption of new technologies and global certification. Therefore, many countries are now showing interest in importing our medicines due to price competitiveness. This is why, the demand of our medicines in the context of export is now higher than any other times of earlier.”

He said Bangladesh can increase its export revenue manifold from pharma sector by investing more on research and development (R&D). “Business-friendly policies are also necessary to explore the sector’s export potential,” said the MD of Square Pharma, which pioneered exports of medicines from Bangladesh in 1987.

The company’s present export market covers 42 countries.

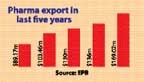

Bangladesh exported pharmaceutical products worth US$ $169.02 million in FY 2020-21.

In FY 2018-19, Bangladesh exported a total of US$130 million worth of medicines, which increased to US$136 million in FY 2019-20, according to Export Promotion Bureau (EPB) data.

Bangladesh’s medicine exports was $103.46 million in FY 2017-18. The country earned US$96.60 million from exports of pharmaceuticals products in 2017-18 fiscal year.

Bangladesh has set a target to export $180 million worth of pharmaceuticals in the current financial year. It has already achieved 71 per cent of the annual target in just six months.

Industry insiders said the pharma sector is expected to grow at 15 per cent year-on-year to reach $5.11 billion by 2023, riding on high investment by local companies which set the target to grab a big share in global market.

At present, there are about 257 pharmaceutical companies in Bangladesh. Square, Beximco, Incepta, Acme, Eskayef, ACI, Reneta and Opsonin are dominating the pharmaceutical market in Bangladesh.

80 per cent of the drugs produced by Bangladeshi companies are generic drugs, rest 20 per cent are patented drugs. However, Bangladeshimports vaccines, anti-cancer products, hormone and some specialized drugs which cannot be manufactured locally.

Local pharmaceutical companies took advantage of Bangladesh’s Least Developed Country (LDC) status that got it exempted from patent protection as well as by producing predominantly patent expired and low-cost generic drugs.

In 2018, the country’s domestic pharmaceutical market size stood at Tk 20,511.8 crore with 15.6 per cent compound annual growth rate (CAGR) for the last five years.