Masuma Begum :

New product development (NDP) is crucial to the success and sustainability of any Business Organization. Bank is a business oriented service industry. Service is its’ only product. Unlike industrial goods, products related to services though have no physical existence, but need to satisfy customer demand as they provide bread and butter for a Bank. Customer satisfaction is very important in Banking Business now a days. The major source of profit is ensured by the way of rendering services to the customer i.e. receive deposits from the customers (depositors), and invest a bulk of deposits to the customers. So, the core of banking business is the satisfaction of customers’ need. In order to make happy the customers the growing Islami banks need to development new product in the area of their demand.

Islami Banking evolved to establish and implemented the objectives of Islami Economics. One of the major objectives of Islamic Economics is to ensure equity and justice in the society through economic activities. So any new product in Islami banking must ensure both of customers satisfaction and justice in the society. Now the question is how to ensure ‘Justice’ in the society? What does ‘Justice’ mean?

The exact connotation of social justice is that our social system should have complete balance between the rights and obligations of individuals and the society. One can be sure of the rights the society guarantees to an individual and those he owes to the society. Both these sets of rights and obligations should be very well defined and safeguarded. The economic exploits of an individual should be in no way detrimental to the interest of the society. The individual should feel convinced that his welfare lies in the welfare of the society and there is no conflict of interests between the two.

To ensure justice in the society it needs better understanding of Islam first. Islam can be divided into three parts that is Aquaid, Akhlakh and Shariah. Aquaid means faith on six things i.e. belief in oneness of Allah, the Angels, Scriptures and Massengers of Allah, the last day (Kiamah) and the life after death (Akhirah).

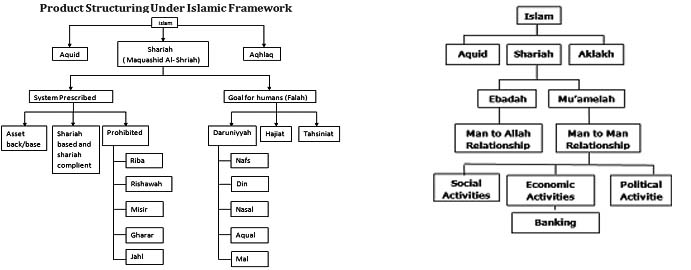

In order to internalize the essence of Shariah, we may divide it into two wings that is rules, regulation or procedure prescribed in Shariah and the Goal (Maquashid) of Shariah (Diagrame 1). Maquashid Al Shariah or goal of shariah is to do welfare (falah) of the human being. The rules and regulations of Shariah must be followed in all of our activities which can be separated into two wings – Abadah and Mu’amelah. Where Abadah means man to Allah relationship and Mu’amelah means man to man relationship. Regarding Abadah, rules and regulations are clearly defined in Quran and Sunnah.

Again Mu’amelah covers all of the elements of our social life, political life and economic life. Banking is an essential part of economic life. In order to follow Shariah in economic life especially in banking activities we must internalize the essence (spirit) of Shariah in the ‘means’ as well as the ‘ends’ part of all our economic activates.

Regarding product development in Islami Banking, it needs to be taken into consideration what are the rules and regulation are prescribed or prohibited in Shariah. Islam provides us a set of divine ordinance. There are some positive motivating instructions such as Zakat, Sadakah, Awqaf, Muhar, Quard, Udhiya , Minah etc. Islami Banking may pay attention to produce new products in the light of these positive instructions. In financial transaction there are five negative instructions which are firmly prohibited in Shariah. These are interest (Riba), gambling (Rishawah), gambling (Mysir), ambiguity (Gharah) and ignorance (Jhal). Under the umbrella of Islami Banking all sorts of products whether it is deposit or investment product must be free from these illegitimate issues. In addition to that these products must be backed by some sort of asset.

Beside the rules and regulations of shariah in designing new products Islamic bank must conform the welfare (falah) of the human being which is the only goal of shariah. Now the question is how welfare can be ensured. According to Imam shatebi human needs can be divided in to three parts. The first one is Daruriyyah (basic needs), the second one is Hajiat (comfort) and the third one is Tahsiniat (social beauty). In Islam the major components of Daruriyyah are protection of life, protection of faith, protection of posterity, protection of intellect, protection of wealth etc. In designing new products whether it is for depositors or entrepreneurs it is needed to be taken into consideration what sort of ‘daruriyyah’ are achieved through these newly developed products. Whether optimum benefits in terms of price, productivity, wider coverage of customers, inclusion of underprivileged section, retention of future growth can be ensured or not?

Islami Bank Bangladesh Limited has been developed it’s deposit or investment products considering both of shariah prescribed rules and regulations as well as the welfare of human being.

In lights of daruriyyah, protection of wealth is one of the most important objectives of Shari’ah. It is the major concern and most important duty for a financial institutions based on Islamic principles to protect the security, benefit, authenticity, transparency of the wealth of the customers. Islami Bank Bangladesh Limited (IBBL) mobilizes deposit basically in two principles, Al- Wadiah principle and Mudaraba principle. There are fourteen different types of deposit accounts under Al- Wadeah and Mudaraba principle. In numerous ways Islami Bank Bangladesh Limited ensure welfare through these deposit products.

Safeguard the wealth and assets of the customer: Through Al- Wadeah Current IBBL receives deposits as an amanah from the mass people and keeps in safe custody of the same and return the deposit on demand of the customers.

Creating savings opportunities for mass people: Islami Bank Bangladesh Limited has designed deposit products in a way that all the people from poor to rich can bring about themselves to IBBL. School going students and farmers are also having the opportunities to save even small amount in the accounts designed and developed for them.

Ensure Maximum Justice in profit distribution: IBBL provides competitive rate of return on deposits accounts considering the importance and requirement of types of depositors and secures profit as per contract.

Establish Human Right: Access to cash and capital is a human right to every man and women. IBBL established this right to the women clients opening separate deposit counter for them. In addition to that staffs take special care to the women with Hijab (Pardanshil women).

Provide Custodian Service: Other than fourteen deposit products IBBL also work as custodian of valuables of all segment of men and women through locker service.

Promote People’s Welfare: Through Mudaraba Waqf Cash Deposit Account IBBL mobilize surplus money from the richest segment of the society, deploy them in various ‘Halal’ types of investment projects and spend the profit to the welfare of the poor segment. In addition to that Mudaraba Special Saving (Pension) Account is special types of opportunity for the retired old people where they deposit an amount of money monthly basis in their account and get the deposited money with handsome return in their old age.

Establish Women’s Economic Right: Through Muhar Savings Account IBBL encourages the married person to pay the ‘muhor’ to their wives which ensure women’s access to their economic resources.

Create Opportunity to accomplish Hajj: Through Mudaraba Hajj Deposit Account IBBL inspires the people to accomplish Hajj which is obligatory for rich people.

Islami Bank Bangladesh Limited (IBBL) deploy fund in seven different investment modes under Trading or ‘Bai’ Machanism, Partnership or ‘Share’ Machanism and Leasing or Ijara Machanism. In case of investment portfolio one of the important objectives of Shariah is the economic welfare of mankind by investing in shariah approved sector other than retain it idle. In many ways Islami Bank Bangladesh Limited ensure welfare through all the investment products. IBBL executes its investment portfolio with a view to ensuring welfare mentioned below.

Prioritize individuals and collective welfare: In all investment operation Islami Bank confirm the welfare of person as well as the mankind a whole. If any investment seems profitable for any individual but harmful to society IBBL do not deploy fund in that project.

Diversification of investment to secure proper circulation of wealth: Banks follow strategic investment policy from short term to long term financing. It helps to create employment opportunities especially to labor intensive projects. Banks impose lower rates to the micro and SMEs which are considered growth of engine.

Welfare and profit oriented investment: IBBL do not invest to produce or trade any harmful or illegal product. It does not take part in transactions targeted towards speculation. Bank invests funds in environment friendly projects. Through RDS and UPDS programs IBBL creates opportunities for the marginal and hard core poor to engage themselves in income generating activities.

All the conventional private commercial banks have a key concern of earning income. So the aim of offering service products in these banks is to maximize profit for which they study four Ps i.e. products design, product promotion, product price and product place in the light of profitability. In designing products, Shariah based banking in Bangladesh must follow four Ps in order to ensure first the goal of Shariah i.e. the welfare of human being as well as the rules and regulation of shariah then Profitability will be ensured as consequence.

New product development (NDP) is crucial to the success and sustainability of any Business Organization. Bank is a business oriented service industry. Service is its’ only product. Unlike industrial goods, products related to services though have no physical existence, but need to satisfy customer demand as they provide bread and butter for a Bank. Customer satisfaction is very important in Banking Business now a days. The major source of profit is ensured by the way of rendering services to the customer i.e. receive deposits from the customers (depositors), and invest a bulk of deposits to the customers. So, the core of banking business is the satisfaction of customers’ need. In order to make happy the customers the growing Islami banks need to development new product in the area of their demand.

Islami Banking evolved to establish and implemented the objectives of Islami Economics. One of the major objectives of Islamic Economics is to ensure equity and justice in the society through economic activities. So any new product in Islami banking must ensure both of customers satisfaction and justice in the society. Now the question is how to ensure ‘Justice’ in the society? What does ‘Justice’ mean?

The exact connotation of social justice is that our social system should have complete balance between the rights and obligations of individuals and the society. One can be sure of the rights the society guarantees to an individual and those he owes to the society. Both these sets of rights and obligations should be very well defined and safeguarded. The economic exploits of an individual should be in no way detrimental to the interest of the society. The individual should feel convinced that his welfare lies in the welfare of the society and there is no conflict of interests between the two.

To ensure justice in the society it needs better understanding of Islam first. Islam can be divided into three parts that is Aquaid, Akhlakh and Shariah. Aquaid means faith on six things i.e. belief in oneness of Allah, the Angels, Scriptures and Massengers of Allah, the last day (Kiamah) and the life after death (Akhirah).

In order to internalize the essence of Shariah, we may divide it into two wings that is rules, regulation or procedure prescribed in Shariah and the Goal (Maquashid) of Shariah (Diagrame 1). Maquashid Al Shariah or goal of shariah is to do welfare (falah) of the human being. The rules and regulations of Shariah must be followed in all of our activities which can be separated into two wings – Abadah and Mu’amelah. Where Abadah means man to Allah relationship and Mu’amelah means man to man relationship. Regarding Abadah, rules and regulations are clearly defined in Quran and Sunnah.

Again Mu’amelah covers all of the elements of our social life, political life and economic life. Banking is an essential part of economic life. In order to follow Shariah in economic life especially in banking activities we must internalize the essence (spirit) of Shariah in the ‘means’ as well as the ‘ends’ part of all our economic activates.

Regarding product development in Islami Banking, it needs to be taken into consideration what are the rules and regulation are prescribed or prohibited in Shariah. Islam provides us a set of divine ordinance. There are some positive motivating instructions such as Zakat, Sadakah, Awqaf, Muhar, Quard, Udhiya , Minah etc. Islami Banking may pay attention to produce new products in the light of these positive instructions. In financial transaction there are five negative instructions which are firmly prohibited in Shariah. These are interest (Riba), gambling (Rishawah), gambling (Mysir), ambiguity (Gharah) and ignorance (Jhal). Under the umbrella of Islami Banking all sorts of products whether it is deposit or investment product must be free from these illegitimate issues. In addition to that these products must be backed by some sort of asset.

Beside the rules and regulations of shariah in designing new products Islamic bank must conform the welfare (falah) of the human being which is the only goal of shariah. Now the question is how welfare can be ensured. According to Imam shatebi human needs can be divided in to three parts. The first one is Daruriyyah (basic needs), the second one is Hajiat (comfort) and the third one is Tahsiniat (social beauty). In Islam the major components of Daruriyyah are protection of life, protection of faith, protection of posterity, protection of intellect, protection of wealth etc. In designing new products whether it is for depositors or entrepreneurs it is needed to be taken into consideration what sort of ‘daruriyyah’ are achieved through these newly developed products. Whether optimum benefits in terms of price, productivity, wider coverage of customers, inclusion of underprivileged section, retention of future growth can be ensured or not?

Islami Bank Bangladesh Limited has been developed it’s deposit or investment products considering both of shariah prescribed rules and regulations as well as the welfare of human being.

In lights of daruriyyah, protection of wealth is one of the most important objectives of Shari’ah. It is the major concern and most important duty for a financial institutions based on Islamic principles to protect the security, benefit, authenticity, transparency of the wealth of the customers. Islami Bank Bangladesh Limited (IBBL) mobilizes deposit basically in two principles, Al- Wadiah principle and Mudaraba principle. There are fourteen different types of deposit accounts under Al- Wadeah and Mudaraba principle. In numerous ways Islami Bank Bangladesh Limited ensure welfare through these deposit products.

Safeguard the wealth and assets of the customer: Through Al- Wadeah Current IBBL receives deposits as an amanah from the mass people and keeps in safe custody of the same and return the deposit on demand of the customers.

Creating savings opportunities for mass people: Islami Bank Bangladesh Limited has designed deposit products in a way that all the people from poor to rich can bring about themselves to IBBL. School going students and farmers are also having the opportunities to save even small amount in the accounts designed and developed for them.

Ensure Maximum Justice in profit distribution: IBBL provides competitive rate of return on deposits accounts considering the importance and requirement of types of depositors and secures profit as per contract.

Establish Human Right: Access to cash and capital is a human right to every man and women. IBBL established this right to the women clients opening separate deposit counter for them. In addition to that staffs take special care to the women with Hijab (Pardanshil women).

Provide Custodian Service: Other than fourteen deposit products IBBL also work as custodian of valuables of all segment of men and women through locker service.

Promote People’s Welfare: Through Mudaraba Waqf Cash Deposit Account IBBL mobilize surplus money from the richest segment of the society, deploy them in various ‘Halal’ types of investment projects and spend the profit to the welfare of the poor segment. In addition to that Mudaraba Special Saving (Pension) Account is special types of opportunity for the retired old people where they deposit an amount of money monthly basis in their account and get the deposited money with handsome return in their old age.

Establish Women’s Economic Right: Through Muhar Savings Account IBBL encourages the married person to pay the ‘muhor’ to their wives which ensure women’s access to their economic resources.

Create Opportunity to accomplish Hajj: Through Mudaraba Hajj Deposit Account IBBL inspires the people to accomplish Hajj which is obligatory for rich people.

Islami Bank Bangladesh Limited (IBBL) deploy fund in seven different investment modes under Trading or ‘Bai’ Machanism, Partnership or ‘Share’ Machanism and Leasing or Ijara Machanism. In case of investment portfolio one of the important objectives of Shariah is the economic welfare of mankind by investing in shariah approved sector other than retain it idle. In many ways Islami Bank Bangladesh Limited ensure welfare through all the investment products. IBBL executes its investment portfolio with a view to ensuring welfare mentioned below.

Prioritize individuals and collective welfare: In all investment operation Islami Bank confirm the welfare of person as well as the mankind a whole. If any investment seems profitable for any individual but harmful to society IBBL do not deploy fund in that project.

Diversification of investment to secure proper circulation of wealth: Banks follow strategic investment policy from short term to long term financing. It helps to create employment opportunities especially to labor intensive projects. Banks impose lower rates to the micro and SMEs which are considered growth of engine.

Welfare and profit oriented investment: IBBL do not invest to produce or trade any harmful or illegal product. It does not take part in transactions targeted towards speculation. Bank invests funds in environment friendly projects. Through RDS and UPDS programs IBBL creates opportunities for the marginal and hard core poor to engage themselves in income generating activities.

All the conventional private commercial banks have a key concern of earning income. So the aim of offering service products in these banks is to maximize profit for which they study four Ps i.e. products design, product promotion, product price and product place in the light of profitability. In designing products, Shariah based banking in Bangladesh must follow four Ps in order to ensure first the goal of Shariah i.e. the welfare of human being as well as the rules and regulation of shariah then Profitability will be ensured as consequence.

(The author is a development research worker)