Abu Sazzad :

Big borrowers have been occupying the lion share of default loan in the last fiscal year (FY) 2014-15 due to dull business amid political instability of the country.

Business sources said, they failed to repay their loan installment timely as they could not run their business smoothly for political unrest across the country.

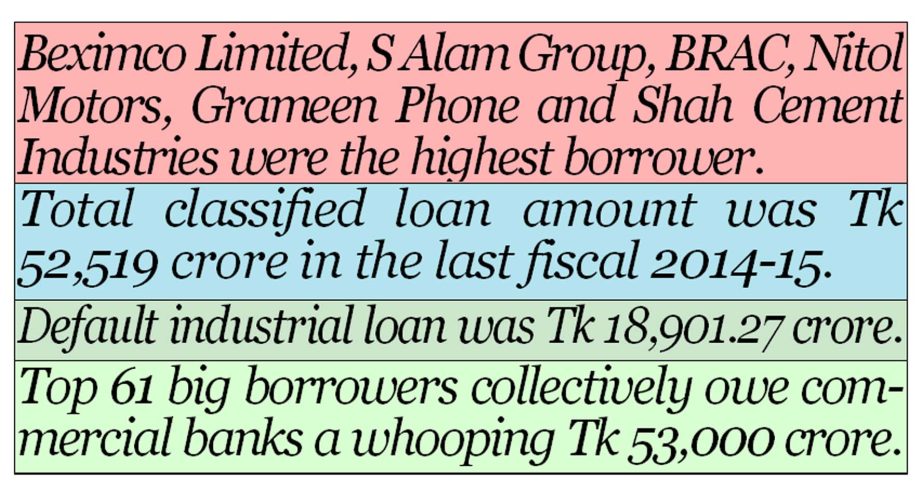

In the last fiscal, the total classified loan amount was Tk 52,519 crore in which the share of default industrial loan was Tk 18,901.27 crore, according to the latest data of Bangladesh Bank.

As far as the size of the default loans in the country’s banking sector is concerned, the situation was not that bad until the end of 2011, but the situation really turned bad from 2012 because of the detection of some large loan scams, particularly with the state-owned banks, banking sources said.

Big borrowers are the big loan defaulters, said the banking sources.

Actually, the recent rise in the amount of default loans was mainly due to the failure of a section of banks to take into consideration the risk factors while sanctioning of some loans of sizeable volume and also to inadequate drive to recover loans in time.

As many as top 61 big borrowers collectively owe commercial banks a whooping Tk 53,000 crore, and each of them borrow more than Tk 500 crore from different lenders, said the sources.

These borrowers account for 25 per cent of total large loan of Tk 215,000 crore. Of them, 21 are loan defaulters, making up 25 per cent of entire default loan valued Tk 20,000 crore.

Beximco Limited, the country’s industrial conglomerate Beximco Group’s flagship company, is the biggest borrowers and loan defaulters as well, borrowing around Tk 3,300 crore in the last fiscal from a consortium of 10 lenders.

S Alam Group came second with a loan of around Tk 6,000 crore in the name of its seven companies having loan exposure of over Tk 500 crore each.

The other large borrowers having exposure over Tk 500 crore to multiple banks and non-bank financial institutions are — BRAC, Nitol Motors, Grameen Phone, S Alam Edible Oil, Shah Cement Industries and many others.

The global recession that affected many of large borrowers, political instability and misuse of banking system leading to thousands of crores of bad loans or non-performing loans.

The steep rise in bad loans in the past few years has forced the central bank to come up recently with strong measures to ensure banks do not sweep bad loans under the carpet giving facilities to restructure loan both for the defaulters and non-defaulters.

On January 27, the central bank had approved a restructuring bad loan policy under which a big borrower would get a maximum of 12 years to repay loans above Tk 500 crore.

Among some of the policies, a big borrower can have the facility only once but has to apply for it by June 30 this year and if a borrower fails to repay two installments consecutively, he will forfeit the facility, and his fate will be decided as per the bankruptcy law.

The disbursement of industrial term loan and its classified amount has risen in a parallel way in the last fiscal.

Industrial term loan disbursement increased significantly in the last fiscal despite political turmoil and inadequate supply of gas and power.

The disbursement of term loan increased by 41.29 per cent in the last fiscal 2015 compared with its previous fiscal 2014. In the last fiscal, the disbursement amount of term loan was Tk 59,783.70 crore which was Tk 42,311.32 crore in the fiscal 2014, according to the latest data of Bangladesh Bank.

On the other hand, experts said, banks have failed to check the classified loan of industrial loan due to political unrest in the first half of the year and violation of rules and regulations by banks in loan disbursement.

Default industrial loans stood at Tk 18,901.27 crore in the FY2015, rising by 24.14 per cent from Tk 15,225.90 crore in the FY2014. The default industrial loan amount was Tk 15,553.05 crore in the fiscal 2012-13.

Most of the commercial banks have recently reduced the lending rate for industrial loan with a view to providing easy financial access to businesses, the Central Bank Executive Director M Mahfuzur Rahman told The New Nation.

“It is good news for our economy that now maximum banks are offering between 13-15 per cent interest for industrial loan which was 18-19 per cent in six months before,” said the central bank executive.

Bangladesh Bank has been encouraging private commercial banks to reduce the lending rate on industrial loan to ensure GDP growth target by increasing inflow of credit to the productive sector, he said. About classified loan, Mahfuzur Rahman said, already the central bank has installed large loan monitoring software. He hoped that the classified loan of the term loan to decline in future due to the policy measure of Bangladesh Bank.

Association of Bankers, Bangladesh (ABB) President and Managing Director of Eastern Bank Ltd, Ali Reza Iftekhar said, the defaulted loan is the key challenge for the banking sector.

“We have to take initiative to reduce the non-performing loans at any cost as the classified loans will foil the capacity and reputation of a bank,” said the ABB President.

He said, “Industrial loan is very important to expand industrialization process in the country, so the credit analysts of the banks have to be cautious to set the credit limit in favor of the industrialists.”.

Centre for Policy Dialogue (CPD) Executive Director Mustafizur Rahman said, the industrial sector faced a major setback in last financial year due to political violence that fuelled the defaulted loans in the sector.

The repayment failure of large loan is a serious threat for the banking sector, reducing banks’ capability to provide fresh loan for long term in future, he observed. Besides, indiscriminate loan disbursement by banks also resulted in soaring defaulted credit in the industrial sector, he claimed.

There was question about the disbursement process of banks loans. The classified loans in the industrial sector increased in the last fiscal, as banks did not disburse the loans to the proper clients, he further claimed. The central bank should speed up its monitoring process to ensure the quality of loan disbursement, otherwise the defaulted large loans will increase further, he suggested.

Due to an increase in non-performing loans, banks’ financial health will be vulnerable that also will weaken the corporate governance, he observed.

Big borrowers have been occupying the lion share of default loan in the last fiscal year (FY) 2014-15 due to dull business amid political instability of the country.

Business sources said, they failed to repay their loan installment timely as they could not run their business smoothly for political unrest across the country.

In the last fiscal, the total classified loan amount was Tk 52,519 crore in which the share of default industrial loan was Tk 18,901.27 crore, according to the latest data of Bangladesh Bank.

As far as the size of the default loans in the country’s banking sector is concerned, the situation was not that bad until the end of 2011, but the situation really turned bad from 2012 because of the detection of some large loan scams, particularly with the state-owned banks, banking sources said.

Big borrowers are the big loan defaulters, said the banking sources.

Actually, the recent rise in the amount of default loans was mainly due to the failure of a section of banks to take into consideration the risk factors while sanctioning of some loans of sizeable volume and also to inadequate drive to recover loans in time.

As many as top 61 big borrowers collectively owe commercial banks a whooping Tk 53,000 crore, and each of them borrow more than Tk 500 crore from different lenders, said the sources.

These borrowers account for 25 per cent of total large loan of Tk 215,000 crore. Of them, 21 are loan defaulters, making up 25 per cent of entire default loan valued Tk 20,000 crore.

Beximco Limited, the country’s industrial conglomerate Beximco Group’s flagship company, is the biggest borrowers and loan defaulters as well, borrowing around Tk 3,300 crore in the last fiscal from a consortium of 10 lenders.

S Alam Group came second with a loan of around Tk 6,000 crore in the name of its seven companies having loan exposure of over Tk 500 crore each.

The other large borrowers having exposure over Tk 500 crore to multiple banks and non-bank financial institutions are — BRAC, Nitol Motors, Grameen Phone, S Alam Edible Oil, Shah Cement Industries and many others.

The global recession that affected many of large borrowers, political instability and misuse of banking system leading to thousands of crores of bad loans or non-performing loans.

The steep rise in bad loans in the past few years has forced the central bank to come up recently with strong measures to ensure banks do not sweep bad loans under the carpet giving facilities to restructure loan both for the defaulters and non-defaulters.

On January 27, the central bank had approved a restructuring bad loan policy under which a big borrower would get a maximum of 12 years to repay loans above Tk 500 crore.

Among some of the policies, a big borrower can have the facility only once but has to apply for it by June 30 this year and if a borrower fails to repay two installments consecutively, he will forfeit the facility, and his fate will be decided as per the bankruptcy law.

The disbursement of industrial term loan and its classified amount has risen in a parallel way in the last fiscal.

Industrial term loan disbursement increased significantly in the last fiscal despite political turmoil and inadequate supply of gas and power.

The disbursement of term loan increased by 41.29 per cent in the last fiscal 2015 compared with its previous fiscal 2014. In the last fiscal, the disbursement amount of term loan was Tk 59,783.70 crore which was Tk 42,311.32 crore in the fiscal 2014, according to the latest data of Bangladesh Bank.

On the other hand, experts said, banks have failed to check the classified loan of industrial loan due to political unrest in the first half of the year and violation of rules and regulations by banks in loan disbursement.

Default industrial loans stood at Tk 18,901.27 crore in the FY2015, rising by 24.14 per cent from Tk 15,225.90 crore in the FY2014. The default industrial loan amount was Tk 15,553.05 crore in the fiscal 2012-13.

Most of the commercial banks have recently reduced the lending rate for industrial loan with a view to providing easy financial access to businesses, the Central Bank Executive Director M Mahfuzur Rahman told The New Nation.

“It is good news for our economy that now maximum banks are offering between 13-15 per cent interest for industrial loan which was 18-19 per cent in six months before,” said the central bank executive.

Bangladesh Bank has been encouraging private commercial banks to reduce the lending rate on industrial loan to ensure GDP growth target by increasing inflow of credit to the productive sector, he said. About classified loan, Mahfuzur Rahman said, already the central bank has installed large loan monitoring software. He hoped that the classified loan of the term loan to decline in future due to the policy measure of Bangladesh Bank.

Association of Bankers, Bangladesh (ABB) President and Managing Director of Eastern Bank Ltd, Ali Reza Iftekhar said, the defaulted loan is the key challenge for the banking sector.

“We have to take initiative to reduce the non-performing loans at any cost as the classified loans will foil the capacity and reputation of a bank,” said the ABB President.

He said, “Industrial loan is very important to expand industrialization process in the country, so the credit analysts of the banks have to be cautious to set the credit limit in favor of the industrialists.”.

Centre for Policy Dialogue (CPD) Executive Director Mustafizur Rahman said, the industrial sector faced a major setback in last financial year due to political violence that fuelled the defaulted loans in the sector.

The repayment failure of large loan is a serious threat for the banking sector, reducing banks’ capability to provide fresh loan for long term in future, he observed. Besides, indiscriminate loan disbursement by banks also resulted in soaring defaulted credit in the industrial sector, he claimed.

There was question about the disbursement process of banks loans. The classified loans in the industrial sector increased in the last fiscal, as banks did not disburse the loans to the proper clients, he further claimed. The central bank should speed up its monitoring process to ensure the quality of loan disbursement, otherwise the defaulted large loans will increase further, he suggested.

Due to an increase in non-performing loans, banks’ financial health will be vulnerable that also will weaken the corporate governance, he observed.